The Hartford 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

Many policyholders with a GMDB also have a GMWB in the U.S. or GMIB in Japan. Policyholders that have a product that offer both

guarantees can only receive the GMDB or the GMIB benefit in Japan or the GMDB or GMWB in the U.S. The GMDB NAR disclosed

in the tables above is a point in time measurement and assumes that all participants utilize the GMDB benefit on that measurement date.

For additional information on the Company's GMDB liability, see Note 11 - Separate Accounts, Death Benefits and Other Insurance

Benefit Features of Notes to Consolidated Financial Statements.

The Company expects to incur GMDB payments in the future only if the policyholder has an “in the money” GMDB at their death. If

the account value is reduced to a specified level, the contract holder will receive an annuity equal to the guaranteed remaining benefit

(“GRB”). For the Company’s “life-time” GMWB products, this annuity can exceed the GRB. As the account value fluctuates with equity

market returns on a daily basis and the “life-time” GMWB payments may exceed the GRB, the ultimate amount to be paid by the

Company, if any, is uncertain and could be significantly more or less than the Company’s current carried liability. For additional

information on the Company’s GMWB liability, see Note 5 - Fair Value Measurements of Notes to Consolidated Financial Statements.

For GMIB contracts, in general, the policyholder has the right to elect to annuitize benefits, beginning (for certain products) on the tenth

or fifteenth anniversary year of contract commencement, receive lump sum payment of the then current account value, or remain in the

variable sub-account. For GMIB contracts, if the policyholder makes the annuitization election, the policyholder is entitled to receive the

original investment value over a 10- to 15- year annuitization period. If the policyholder defers this election, the policyholder has the

right to revisit the election annually on the policy anniversary date. A small percentage of the contracts first became eligible to elect

annuitization in the third and fourth quarter of 2013. The remainder of the contracts will first become eligible to elect annuitization from

2014 to 2022. Because policyholders have various contractual rights to defer their annuitization election, the period over which

annuitization election can take place is subject to policyholder behavior and therefore indeterminate. In addition, upon annuitization the

contractholder surrenders access to the account value and the account value is transferred to the Company’s general account where it is

invested and the additional investment proceeds are used towards payment of the original investment value. If the original investment

value exceeds the account value upon annuitization then the contract is “in the money”. As of December 31, 2013, approximately 80%

of the Japan GMIB contracts were "out of the money". The Company reinsures a majority of the GMIB benefits with an affiliated

captive reinsurer. For additional information on the Company’s GMIB liability, see Note 11 - Separate Accounts, Death Benefits and

Other Insurance Benefit Features of Notes to Consolidated Financial Statements.

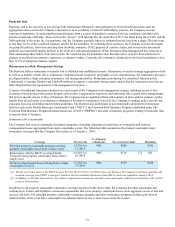

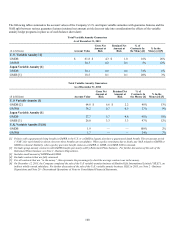

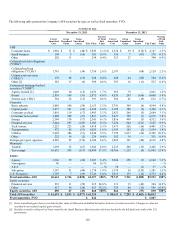

The following table represents the timing of account values eligible for annuitization under the Japan GMIB as well as the NAR. The

account values reflect 100% annuitization at the earliest point allowed by the contract and no adjustments for future market returns and

policyholder behaviors. Future market returns, changes in the value of the Japanese yen and policyholder behaviors will impact account

values eligible for annuitization in the years presented.

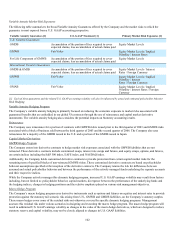

GMIB [1] As of December 31, 2013

($ in billions) Account Value Net Amount at Risk

2014 $ 2.2 $ —

2015 4.4 —

2016 2.0 —

2017 2.4 0.1

2018 1.1 —

2019 & beyond [2] 4.2 —

Total $ 16.3 $ 0.1

[1] Excludes certain non-GMIB living benefits of $2.2billion of account value and $0.0 billion of NAR.

[2] In 2019 & beyond, $2.0 billion of the $4.2 billion is associated with account value that is eligible in 2021.