The Hartford 2013 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.107

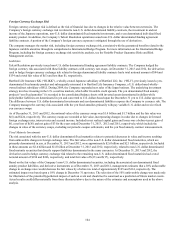

Credit risk policies at the enterprise and operation level ensure comprehensive and consistent approaches to quantifying, evaluating, and

managing credit risk under expected and stressed conditions. These policies define the scope of the risk, authorities, accountabilities,

terms, and limits, and are regularly reviewed and approved by senior management and ERM. Aggregate counterparty credit quality and

exposure is monitored on a daily basis utilizing an enterprise-wide credit exposure information system that contains data on issuers,

ratings, exposures, and credit limits. Exposures are tracked on a current and potential basis. Credit exposures are reported regularly to

the ERCC and to the Finance, Investment and Risk Management Committee (“FIRMCo”). Exposures are aggregated by ultimate parent

across investments, reinsurance receivables, insurance products with credit risk, and derivative counterparties. The credit database and

reporting system are available to all key credit practitioners in the enterprise.

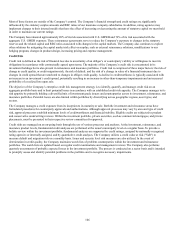

The Company exercises various and differing methods to mitigate its credit risk exposure within its investment and reinsurance

portfolios. Some of the reasons for mitigating credit risk include financial instability or poor credit, avoidance of arbitration or litigation,

future uncertainty, and exposure in excess of risk tolerances. Credit risk within the investment portfolio is most commonly mitigated

through asset sales or the use of derivative instruments. Counterparty credit risk is mitigated through the practice of entering into

contracts only with highly creditworthy institutions and through the practice of holding and posting of collateral. In addition, transactions

cleared through a central clearing house reduce risk due to their ability to require daily variation margin, monitor the Company's ability to

request additional collateral in the event of a counterparty downgrade, and be an independent valuation source. Systemic credit risk is

mitigated through the construction of high-quality, diverse portfolios that are subject to regular underwriting of credit risks. For further

discussion of the Company’s investment and derivative instruments, see the Portfolio Risks and Risk Management section and Note 6 of

Notes to Consolidated Financial Statements. Further discussion on managing and mitigating credit risk from the use of reinsurance via

an enterprise security review process, see the Reinsurance as a Risk Management Strategy within the Insurance Risk Management

section.

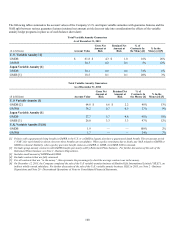

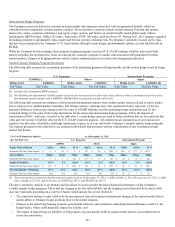

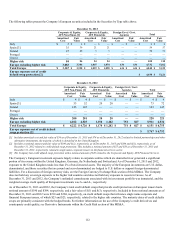

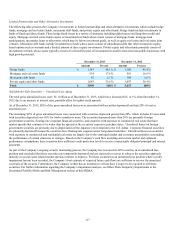

As of December 31, 2013, the Company's only exposure to any credit concentration risk of a single issuer or counterparty greater than

10% of the Company's stockholders' equity, other than the U.S. government and certain U.S. government securities, was the Government

of Japan and Prudential. The Government of Japan securities represented $2.6 billion, or 14% of stockholders' equity, and 3% of total

invested assets. For further discussion of concentration of credit risk, see the Concentration of Credit Risk section in Note 6 of Notes to

Consolidated Financial Statements. The net unsecured reinsurance recoverable from Prudential of $2.4 billion represented

approximately 13% of stockholders' equity. For further discussion of reinsurance recoverables, see Note 7 - Reinsurance of Notes to

Consolidated Financial Statements.

Derivative Instruments

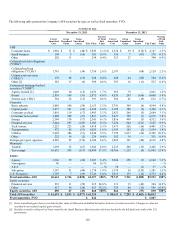

The Company utilizes a variety of OTC, OTC-cleared and exchange-traded derivative instruments as a part of its overall risk

management strategy, as well as to enter into replication transactions. Derivative instruments are used to manage risk associated with

interest rate, equity market, credit spread, issuer default, price, and currency exchange rate risk or volatility. Replication transactions are

used as an economical means to synthetically replicate the characteristics and performance of assets that would be permissible

investments under the Company’s investment policies. For further information on the Company’s use of derivatives, see Note 6 of Notes

to Consolidated Financial Statements.

Derivative activities are monitored and evaluated by the Company’s compliance and risk management teams and reviewed by senior

management. Downgrades to the credit ratings of The Hartford’s insurance operating companies may have adverse implications for its

use of derivatives including those used to hedge benefit guarantees of variable annuities. In some cases, downgrades may give derivative

counterparties for OTC derivatives the unilateral contractual right to cancel and settle outstanding derivative trades or require additional

collateral to be posted. In addition, downgrades may result in counterparties becoming unwilling to engage in additional OTC

derivatives or may require collateralization before entering into any new trades. This will restrict the supply of derivative instruments

commonly used to hedge variable annuity guarantees, particularly long-dated equity derivatives and interest rate swaps. Under these

circumstances, the Company’s operating subsidiaries could conduct hedging activity using a combination of cash, OTC-cleared and

exchange-traded instruments, in addition to using the available OTC derivatives.

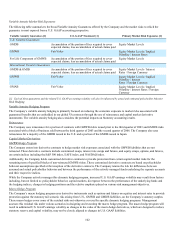

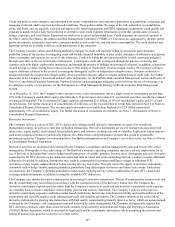

The Company uses various derivative counterparties in executing its derivative transactions. The use of counterparties creates credit risk

that the counterparty may not perform in accordance with the contractual terms of the derivative transaction. The Company has

derivative counterparty exposure policies which limit the Company’s exposure to credit risk and monitors counterparty credit exposure

on a monthly basis to ensure compliance with company policies and statutory limitations. The Company’s policies with respect to

derivative counterparty exposure establishes market-based credit limits, favors long-term financial stability and creditworthiness of the

counterparty and typically requires credit enhancement/credit risk reducing agreements. The Company minimizes the credit risk of

derivative instruments by entering into transactions with high quality counterparties primarily rated A or better, which are monitored and

evaluated by the Company’s risk management team and reviewed by senior management. The Company also generally requires that

OTC derivative contracts, other than certain forward contracts, be governed by an International Swaps and Derivatives Association

("ISDA") Master Agreement, which is structured by legal entity and by counterparty and reduces risk by permitting the closeout and

netting of transactions upon the occurrence of certain events.