The Hartford 2013 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2013 The Hartford annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

THE HARTFORD FINANCIAL SERVICES GROUP, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

2. Business Dispositions (continued)

F-21

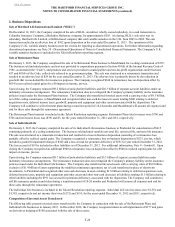

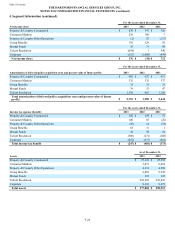

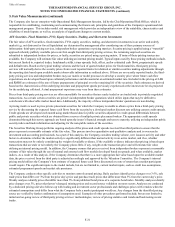

As of December 31, 2012

Carrying Value

Total fixed maturities, AFS at fair value (amortized cost of $13,916) [1] 15,349

Equity securities, AFS, at fair value (cost of $35) [2] 37

Fixed maturities, at fair value using the FVO [3] 16

Mortgage loans (net of allowances for loan losses of $1) 1,364

Policy loans, at outstanding balance 582

Total invested assets transferred $ 17,348

[1] Includes $14.7 billion and $670 of securities in level 2 and 3 of the fair value hierarchy, respectively.

[2] All equity securities transferred are included in level 2 of the fair value hierarchy.

[3] All FVO securities transferred are included in level 3 of the fair value hierarchy.

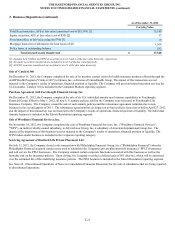

Sale of Catalyst 360

On December 31, 2013, the Company completed the sale of its member contact center for health insurance products offered through the

AARP Health Program ("Catalyst 360") to Optum, Inc., a division of UnitedHealth Group. The impact of this transaction was not

material to the Company's results of operations, financial position or liquidity. The Company will provide limited transition services for

18-24 months. Catalyst 360 is included in the Consumer Markets reporting segment.

Purchase Agreement with Forethought Financial Group, Inc.

On December 31, 2012, the Company completed the sale of its U.S. individual annuity new business capabilities to Forethought

Financial Group. Effective May 1, 2012, all new U.S. annuity policies sold by the Company were reinsured to Forethought Life

Insurance Company. The Company ceased the sale of such annuity policies and the reinsurance agreement terminated as to new

business in the second quarter of 2013. The reinsurance agreement has no impact on in-force policies issued on or before April 27, 2012

and the impact of this transaction was not material to the Company's results of operations, financial position or liquidity. The Individual

Annuity business is included in the Talcott Resolution reporting segment.

Sale of Woodbury Financial Services, Inc.

On November 30, 2012, the Company completed the sale of Woodbury Financial Services, Inc. ("Woodbury Financial Services",

"WFS"), an indirect wholly-owned subsidiary, to AIG Advisor Group, Inc, a subsidiary of American International Group, Inc. The

impact of the disposition of this business was not material to the Company's results of operations, financial position or liquidity. The

WFS broker-dealer business is included in the Corporate reporting category.

Servicing Agreement of Hartford Life Private Placement LLC

On July 13, 2012, the Company closed a sale transaction with Philadelphia Financial Group, Inc. (“Philadelphia Financial”) whereby

Philadelphia Financial acquired certain assets used to administer the Company's private placement life insurance (“PPLI”) businesses

and will service the PPLI businesses. The Company retained certain corporate functions associated with this business as well as the

mortality risk on the insurance policies. Upon closing, the Company recorded a deferred gain of $61 after-tax, which will be amortized

over the estimated life of the underlying insurance policies. The PPLI business is included in the Talcott Resolution reporting segment.

See Note 20 - Discontinued Operations of Notes to Consolidated Financial Statements for the sale of subsidiaries that are being reported

as discontinued operations.