Symantec 2015 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

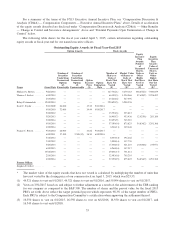

For a summary of the terms of the FY15 Executive Annual Incentive Plan, see “Compensation Discussion &

Analysis (CD&A) — Compensation Components — Executive Annual Incentive Plans” above. Details of acceleration

of the equity awards described are disclosed under “Compensation Discussion & Analysis (CD&A) — Other Benefits

— Change in Control and Severance Arrangements” above and “Potential Payments Upon Termination or Change in

Control” below.

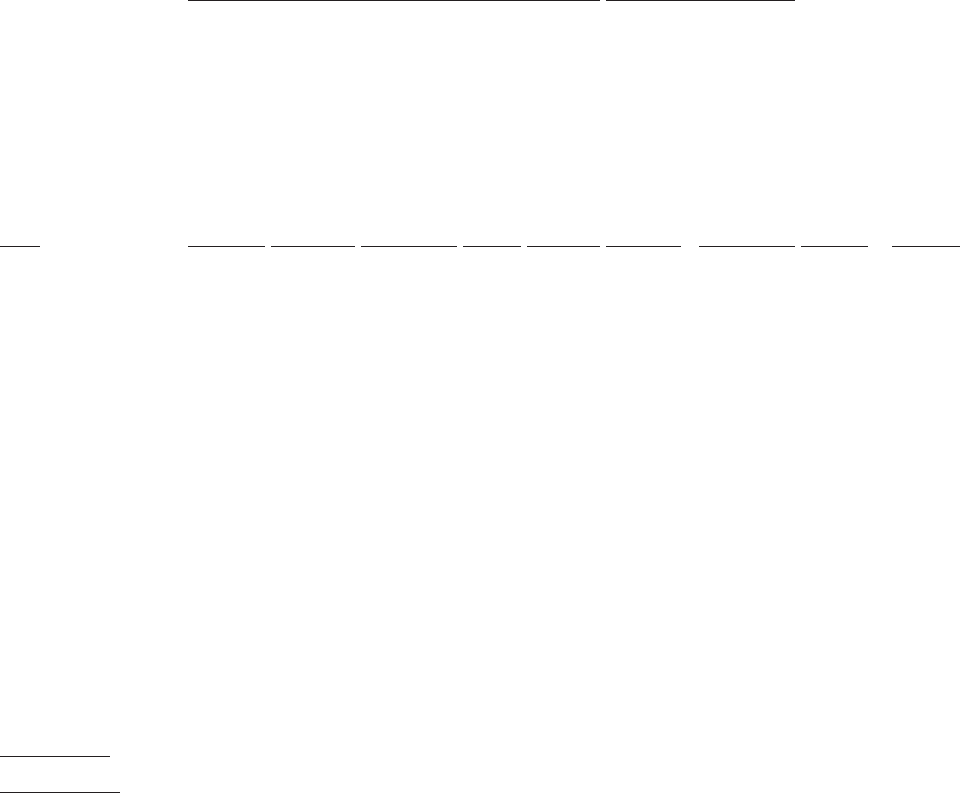

The following table shows for the fiscal year ended April 3, 2015, certain information regarding outstanding

equity awards at fiscal year end for our named executive officers.

Outstanding Equity Awards At Fiscal Year-End 2015

Option Awards Stock Awards

Name Grant Date

Number of

Securities

Underlying

Unexercised

Options

(#)

Exercisable

Number of

Securities

Underlying

Unexercised

Options

(#)

Unexercisable

Option

Exercise

Price

($)

Option

Expiration

Date

Number of

Shares or

Units of

Stock That

Have Not

Vested

(#)

Market Value

of Shares or

Units of

Stock That

Have Not

Vested

($)*

Equity

Incentive

Plan

Awards:

Number

of

Unearned

Shares,

Units or

Other

Rights

that Have

Not Yet

Vested

(#)

Equity

Incentive

Plan

Awards:

Value of

Unearned

Shares,

Units or

Other

Rights

that Have

Not Yet

Vested

($)*

Michael A. Brown ....... 9/24/2014 — — — — 147,736(1) 3,479,183 338,856(2) 7,980,059

Thomas J. Seifert ........ 6/10/2014 — — — — 66,199(3) 1,558,986 97,609(2) 2,298,692

6/10/2014 — — — — 23,244(4) 547,396 — —

Balaji Yelamanchili ...... 12/10/2014 — — — — 220,822(5) 5,200,358

Scott C. Taylor .......... 5/11/2009 26,000 — 15.32 5/11/2016 — — — —

6/10/2010 72,000 — 14.44 6/10/2017 — — — —

5/10/2012 — — — — 13,750(6) 323,813 — —

5/20/2013 — — — — 18,405(7) 433,438 12,025(8) 283,189

2/10/2014 — — — — 32,493(9) 765,210

6/10/2014 — — — — 37,190(10) 875,825 54,836(2) 1,291,388

6/10/2014 — — — — 6,346(11) 149,448 —

Francis C. Rosch......... 9/10/2010 28,000 — 14.86 9/10/2017 — — — —

6/10/2011 37,500 2,500(12) 18.50 6/10/2018 — — — —

5/10/2012 — — — — 8,333(13) 196,242 — —

7/10/2012 — — — — 5,000(14) 117,750 —

5/20/2013 — — — — 15,338(15) 361,210 10,020(8) 235,971

6/10/2013 — — — — 6,264(16) 147,517 — —

10/10/2013 — — — — 29,801(17) 701,814 — —

2/10/2014 — — — — 32,493(18) 765,210 — —

6/10/2014 — — — — 37,190(19) 875,825 54,836(2) 1,291,388

Former Officer:

Stephen E. Gillett ........ — — — — — — — — —

* The market value of the equity awards that have not vested is calculated by multiplying the number of units that

have not vested by the closing price of our common stock on April 3, 2015, which was $23.55.

(1) 44,321 shares to vest on 9/1/2015, 44,321 shares to vest on 9/1/2016, and 59,094 shares to vest on 9/1/2017.

(2) Vests on 3/31/2017 based on, and subject to further adjustment as a result of, the achievement of the TSR ranking

for our company as compared to the S&P 500. The number of shares and the payout value for the fiscal 2015

PRUs set forth above reflect the target potential payout which represents 98.3% of the target number of PRUs.

Each PRU is subject to the Compensation Committee’s certification when approving the settlement thereof.

(3) 16,550 shares to vest on 6/1/2015, 16,550 shares to vest on 6/1/2016, 16,550 shares to vest on 6/1/2017, and

16,549 shares to vest on 6/1/2018.

55