Symantec 2015 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(2) These amounts are associated with agreements for purchases of goods or services generally including

agreements that are enforceable and legally binding and that specify all significant terms, including

fixed or minimum quantities to be purchased; fixed, minimum, or variable price provisions; and the

approximate timing of the transaction. The table above also includes agreements to purchase goods or

services that have cancellation provisions requiring little or no payment. The amounts under such

contracts are included in the table above because management believes that cancellation of these

contracts is unlikely and we expect to make future cash payments according to the contract terms or in

similar amounts for similar materials.

(3) We have entered into various noncancelable operating lease agreements that expire on various dates

through fiscal 2029. The amounts in the table above exclude expected sublease income and include $6

million in exited or excess facility costs related to restructuring activities.

(4) Due to the uncertainty with respect to the timing of future cash flows associated with our unrecognized

tax benefits as of April 3, 2015 we are unable to make reasonably reliable estimates of the period of

cash settlement with the respective taxing authorities. Therefore, $134 million in long-term income

taxes payable has been excluded from the contractual obligations table. For further information, see

Note 11 of the Notes to Consolidated Financial Statements in this annual report.

Indemnifications

In the ordinary course of business, we may provide indemnifications of varying scope and terms to

customers, vendors, lessors, business partners, subsidiaries and other parties with respect to certain matters,

including, but not limited to, losses arising out of our breach of agreements or representations and warranties

made by us. In addition, our bylaws contain indemnification obligations to our directors, officers, employees and

agents, and we have entered into indemnification agreements with our directors and certain of our officers to give

such directors and officers additional contractual assurances regarding the scope of the indemnification set forth

in our bylaws and to provide additional procedural protections. We maintain director and officer insurance,

which may cover certain liabilities arising from our obligation to indemnify our directors and officers. It is not

possible to determine the aggregate maximum potential loss under these indemnification agreements due to the

limited history of prior indemnification claims and the unique facts and circumstances involved in each particular

agreement. Such indemnification agreements might not be subject to maximum loss clauses. Historically, we

have not incurred material costs as a result of obligations under these agreements and we have not accrued any

liabilities related to such indemnification obligations in our Consolidated Financial Statements.

We provide limited product warranties and the majority of our software license agreements contain

provisions that indemnify licensees of our software from damages and costs resulting from claims alleging that

our software infringes on the intellectual property rights of a third party. Historically, payments made under these

provisions have been immaterial. We monitor the conditions that are subject to indemnification to identify if a

loss has occurred.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk

We are exposed to various market risks related to fluctuations in interest rates and foreign currency

exchange rates. We may use derivative financial instruments to mitigate certain risks in accordance with our

investment and foreign exchange policies. We do not use derivatives or other financial instruments for trading or

speculative purposes.

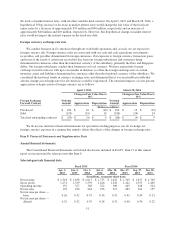

Interest rate risk

As of April 3, 2015 and March 28, 2014, we had $2.1 billion in principal amount of fixed-rate senior notes

outstanding, with a carrying amount of $2.1 billion and a fair value of $2.2 billion, which fair value is based on

level 2 inputs. We have performed sensitivity analyses as of April 3, 2015 and March 28, 2014 by using a

modeling technique that measures the change in the fair values arising from a hypothetical 50 bps movement in

50