Symantec 2015 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

closing agreement. We also amended our state tax returns for the Veritas 2002 through 2005 tax years in fiscal

2013 to reflect the adjustments in the closing agreement and remeasured our state liability resulting in a benefit

of $7 million.

On September 3, 2013, we settled and effectively settled matters with the IRS for the Symantec 2005

through 2008 fiscal years. The result of the settlements, effective settlements, and re-measurements resulted in a

reduction in the balance of our gross unrecognized tax benefits in fiscal year 2014 of $122 million.

On March 18, 2015, we settled and effectively settled matters with the IRS for the Symantec 2009 through

2013 fiscal years. The settlement and effective settlement resulted in a benefit to tax expense in fiscal year 2015

of $59 million. Additionally, the Company settled transfer price related matters of $158 million, a portion of

which was accounted for against deferred tax liabilities on unremitted foreign earnings. The Company has paid in

$155 million to cover the final tax and interest liability on the settlement.

The timing of the resolution of income tax examinations is highly uncertain, and the amounts ultimately

paid, if any, upon resolution of the issues raised by the taxing authorities may differ materially from the amounts

accrued for each year. Although potential resolution of uncertain tax positions involve multiple tax periods and

jurisdictions, it is reasonably possible that the gross unrecognized tax benefits related to these audits could

decrease (whether by payment, release, or a combination of both) in the next 12 months by $44 million.

Depending on the nature of the settlement or expiration of statutes of limitations, we estimate $44 million could

affect our income tax provision and therefore benefit the resulting effective tax rate.

We continue to monitor the progress of ongoing income tax controversies and the impact, if any, of the

expected tolling of the statute of limitations in various taxing jurisdictions.

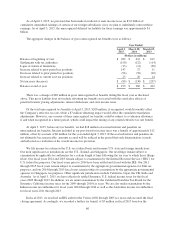

Note 12. Earnings Per Share

Basic and diluted earnings per share are computed on the basis of the weighted-average number of shares of

common stock outstanding during the period. Diluted earnings per share also include the incremental effect of

dilutive potential common shares outstanding during the period using the treasury stock method. Dilutive

potential common shares include the dilutive effect of shares underlying outstanding stock options, restricted

stock, warrants, ESPP and convertible senior notes.

The components of earnings per share attributable to Symantec Corporation stockholders are as follows:

Year Ended

April 3,

2015

March 28,

2014

March 29,

2013

(In millions, except per share data)

Net income $ 878 $ 898 $ 755

Net income per share — basic $ 1.27 $ 1.29 $ 1.08

Net income per share — diluted $ 1.26 $ 1.28 $ 1.06

Weighted-average shares outstanding — basic 689 696 701

Dilutive potential shares from stock-based compensation 7 8 10

Weighted-average shares outstanding — diluted 696 704 711

Anti-dilutive effect of stock-based compensation and note hedge 1 5 24

Note 13. Subsequent Event

On January 24, 2011, a class action lawsuit was filed against the Company and its previous e-commerce

vendor Digital River, Inc. Against the Company, the lawsuit alleged violations of California’s Unfair

Competition Law, the California Legal Remedies Act and unjust enrichment related to prior sales of Extended

87