Symantec 2015 Annual Report Download - page 148

Download and view the complete annual report

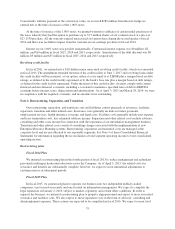

Please find page 148 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.related liability. The new standard is effective for the Company April 2, 2016. Early adoption is permitted and we

expect to adopt the standard in the fiscal period beginning April 4, 2015. We do not expect that this standard will

have a material impact on our Consolidated Financial Statements and related disclosures.

There was no other recently issued authoritative guidance that is expected to have a material impact to our

Consolidated Financial Statements through the reporting date.

Note 2. Fair Value Measurements

For assets and liabilities measured at fair value, such amounts are based on an expected exit price

representing the amount that would be received on the sale of an asset or paid to transfer a liability, as the case

may be, in an orderly transaction between market participants. As such, fair value may be based on assumptions

that market participants would use in pricing an asset or liability. The authoritative guidance on fair value

measurements establishes a consistent framework for measuring fair value on either a recurring or nonrecurring

basis whereby inputs, used in valuation techniques, are assigned a hierarchical level. The following are the

hierarchical levels of inputs to measure fair value:

• Level 1: Observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in

active markets.

• Level 2: Observable inputs that reflect quoted prices for identical assets or liabilities in markets that are

not active; quoted prices for similar assets or liabilities in active markets; inputs other than quoted

prices that are observable for the assets or liabilities; or inputs that are derived principally from or

corroborated by observable market data by correlation or other means.

• Level 3: Unobservable inputs reflecting our own assumptions incorporated in valuation techniques

used to determine fair value. These assumptions are required to be consistent with market participant

assumptions that are reasonably available.

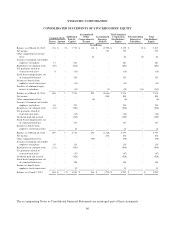

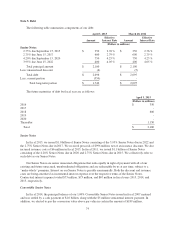

Assets measured and recorded at fair value on a recurring basis

Cash equivalents. Cash equivalents consist primarily of money market funds with original maturities of

three months or less at the time of purchase, and the carrying amount is a reasonable estimate of fair value.

Short-term investments. Short-term investments consist of investment and marketable equity securities with

original maturities greater than three months. Investment securities are priced using inputs such as actual trade

data, benchmark yields, broker/dealer quotes, and other similar data, which are obtained from quoted market

prices, independent pricing vendors, or other sources, to determine the fair value of these assets. Marketable

equity securities are recorded at fair value using quoted prices in active markets for identical assets.

70