Symantec 2015 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Investing activities

Net cash used in investing activities was $1.2 billion for fiscal 2015 and was primarily due to the purchase

of $1.8 billion of short-term investments and payments of $381 million for capital expenditures, partially offset

by proceeds of $681 million from maturities of short-term investments and $343 million from sales of our short-

term investments.

Net cash used in investing activities was $583 million for fiscal 2014 and was primarily due to payments of

$260 million for capital expenditures, and $492 million in purchases of short-term investments, partially offset

by $186 million in proceeds from the sales and maturities of our short-term investments.

Net cash used in investing activities was $319 million for fiscal 2013 and was primarily due to payments of

$336 million for capital expenditures, partially offset by $46 million in proceeds from the sales and maturities of

our short-term investments.

Financing activities

Net cash used in financing activities was $811 million for fiscal 2015, which was primarily due to

repurchases of our common stock of $500 million and cash dividend payments of $413 million, partially offset

by proceeds from sales of common stock under employee stock benefit plans of $116 million.

Net cash used in financing activities was $1.7 billion for fiscal 2014, which was primarily due to the

repayment of our convertible senior notes of $1.0 billion, repurchases of our common stock of $500 million and

cash dividends paid of $418 million, partially offset by net proceeds from sales of common stock through

employee stock benefit plans of $234 million.

Net cash provided by financing activities of $308 million for fiscal 2013 was primarily due to the $996

million net proceeds generated from our issuance of $600 million in principal amount of 2.75% interest-bearing

senior notes due June 15, 2017 and $400 million in principal amount of 3.95% interest-bearing senior notes due

June 15, 2022, and net proceeds from sales of common stock through employee stock benefit plans of $281

million, partially offset by repurchases of our common stock of $826 million and the purchase of additional

equity interest in subsidiary of $111 million.

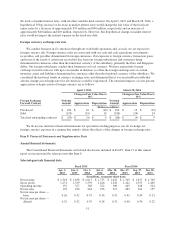

Contractual obligations

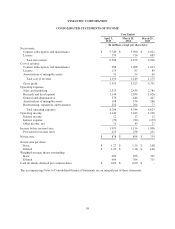

The following is a schedule by years of our significant contractual obligations as of April 3, 2015:

Payments Due by Fiscal Period

Total 2016 2017 - 2018 2019 - 2020 Thereafter

(Dollars in millions)

Senior Notes (1) $ 2,100 $ 350 $ 600 $ - $ 1,150

Interest payments on Senior Notes (1) 327 68 115 95 49

Purchase obligations (2) 542 539 3 - -

Operating leases (3) 442 103 150 104 85

Uncertain tax positions (4) 29 29 - - -

Total $ 3,440 $ 1,089 $ 868 $ 199 $ 1,284

(1) In fiscal 2011, we issued $350 million in principal amount of 2.75% senior notes due September 2015

and $750 million in principal amount of 4.20% senior notes due September 2020. In fiscal 2013, we

issued $600 million in principal amount of 2.75% senior notes due June 2017 and $400 million in

principal amount of 3.95% senior notes due June 2022. Interest payments were calculated based on

terms of the related senior notes. For further information on the senior notes, see Note 5 of the Notes to

Consolidated Financial Statements in this annual report.

49