Symantec 2015 Annual Report Download - page 164

Download and view the complete annual report

Please find page 164 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As of April 3, 2015, no provision has been made for federal or state income taxes on $3.6 billion of

cumulative unremitted earnings of certain of our foreign subsidiaries since we plan to indefinitely reinvest these

earnings. As of April 3, 2015, the unrecognized deferred tax liability for these earnings was approximately $1

billion.

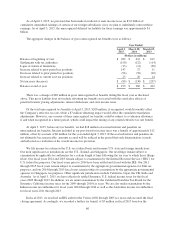

The aggregate changes in the balance of gross unrecognized tax benefits were as follows:

Year Ended

April 3,

2015

March 28,

2014

March 29,

2013

(Dollars in millions)

Balance at beginning of year $ 282 $ 412 $ 619

Settlements with tax authorities (150) (122) (114)

Lapse of statute of limitations (13) (11) (98)

Increase related to prior period tax positions 147 27 11

Decrease related to prior period tax positions (96) (50) (20)

Increase related to current year tax positions 23 26 14

Net increase (decrease) $ (89) $ (130) $ (207)

Balance at end of year $ 193 $ 282 $ 412

There was a change of $89 million in gross unrecognized tax benefits during the fiscal year as disclosed

above. This gross liability does not include offsetting tax benefits associated with the correlative effects of

potential transfer pricing adjustments, interest deductions, and state income taxes.

Of the total unrecognized tax benefits at April 3, 2015, $200 million, if recognized, would favorably affect

the Company’s effective tax rate, while a $7 million offsetting impact would affect the cumulative translation

adjustments. However, one or more of these unrecognized tax benefits could be subject to a valuation allowance

if and when recognized in a future period, which could impact the timing of any related effective tax rate benefit.

At April 3, 2015, before any tax benefits, we had $18 million of accrued interest and penalties on

unrecognized tax benefits. Interest included in our provision for income taxes was a benefit of approximately $12

million, offset by accruals of $6 million for the year ended April 3, 2015. If the accrued interest and penalties do

not ultimately become payable, amounts accrued will be reduced in the period that such determination is made,

and reflected as a reduction of the overall income tax provision.

We file income tax returns in the U.S. on a federal basis and in many U.S. state and foreign jurisdictions.

Our most significant tax jurisdictions are the U.S., Ireland, and Singapore. Our tax filings remain subject to

examination by applicable tax authorities for a certain length of time following the tax year to which those filings

relate. Our fiscal years 2014 and 2015 remain subject to examination by the Internal Revenue Service (“IRS”) for

U.S. federal tax purposes. Our fiscal years prior to 2014 have been settled and closed with the IRS. Our 2011

through 2015 fiscal years remain subject to examination by the appropriate governmental agencies for Irish tax

purposes, and our 2014 through 2015 fiscal years remain subject to examination by the appropriate governmental

agencies for Singapore tax purposes. Other significant jurisdictions include California, Japan, the UK, India and

Australia. As of April 3, 2015, we have effectively settled Symantec U.S. federal income taxes for the fiscal

years 2009 through 2013. In addition, we are under examination by the California Franchise Tax Board for the

Symantec California income taxes for the 2009 through 2010 tax years. We are also under examination by the

Indian income tax authorities for fiscal years 2004 through 2014 as well as the Australian income tax authorities

for fiscal years 2011 through 2013.

In fiscal 2013, we resolved an IRS audit for the Veritas 2002 through 2005 tax years and executed the final

closing agreement. Accordingly, we recorded a further tax benefit of $3 million in fiscal 2013 based on the

86