Symantec 2015 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

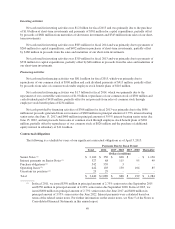

2015 compared to 2014:

Non-operating expense, net, increased $29 million primarily due to a $32 million realized gain from sale of

short-term investments during fiscal 2014 that did not recur in fiscal 2015.

2014 compared to 2013:

Non-operating expense, net, decreased $73 million primarily due to a $32 million realized gain from sale of

short-term investments during fiscal 2014, coupled with a decrease in interest expense of $55 million as we

experienced lower amortization of debt issuance costs and discounts following the maturity of our $1.0 billion

1.00% notes in June 2013.

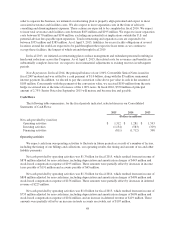

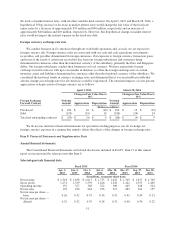

Provision for income taxes

Change in %

2015 2014 2013 2015 v 2014 2014 v 2013

(Dollars in millions)

Provision for income taxes $ 215 $ 258 $ 251 (17)% 3%

Effective tax rate on earnings 20% 22% 25% (2)% (3)%

Our effective tax rate was approximately 20%, 22%, and 25% in fiscal 2015, 2014, and 2013, respectively.

The tax expense in fiscal 2015 was reduced by the following benefits: (1) $59 million for tax benefits

related to the settlement of the Symantec 2009 through 2013 Internal Revenue Service (“IRS”) audit, (2) $21

million in tax benefits resulting from tax settlements and lapses of statutes of limitations, (3) $14 million in tax

benefits related to certain foreign operations, and (4) $14 million in tax benefits resulting from deductible

separation costs.

The tax expense in fiscal 2014 was reduced by the following benefits: (1) $33 million for the resolution of a

tax matter related to the sale of our 49% ownership interest in the joint venture with Huawei during the fourth

quarter of fiscal 2012, (2) $24 million for tax benefits related to the settlement of the Symantec 2005 through

2008 IRS audit, (3) $15 million tax benefit related to certain foreign operations, and (4) $13 million from lapses

of statutes of limitation. These tax benefits were partially offset by $12 million in tax expense, resulting from the

sale of short-term investments.

The tax expense in fiscal 2013 was reduced by the following benefits: (1) $17 million tax benefits arising

from the Veritas 2002 through 2005 IRS Appeals matters, including adjustments to state liabilities and a

reduction of interest accrued, (2) $13 million in tax benefits resulting from tax settlements and adjustments to

prior year items, (3) $10 million from lapses of statutes of limitation, and (4) $2 million for the benefit of the

research credit for the fourth quarter of fiscal 2012 resulting from the extension of the federal research credit as

part of the 2012 Taxpayer Relief Act. These tax benefits were offset by a $9 million tax expense from an increase

in valuation allowance on state research tax credits.

The effective tax rates for all periods presented otherwise reflect the benefits of lower-taxed international

earnings, domestic manufacturing incentives, and research and development credits (of which the U.S. federal

research and development credit expired on December 31, 2014), partially offset by state income taxes.

We are a U.S.-based multinational company subject to tax in multiple U.S. and international tax

jurisdictions. A substantial portion of our international earnings were generated from subsidiaries organized in

Ireland and Singapore. Our results of operations would be adversely affected to the extent that our geographical

mix of income becomes more weighted toward jurisdictions with higher tax rates and would be favorably

affected to the extent the relative geographic mix shifts to lower tax jurisdictions. Any change in our mix of

earnings is dependent upon many factors and is therefore difficult to predict.

45