Symantec 2015 Annual Report Download - page 62

Download and view the complete annual report

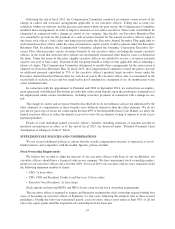

Please find page 62 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(10) Represents a one-time sign-on bonus, which Mr. Seifert is obligated to repay all or a portion of the sign-on

bonus if he voluntarily leaves the Company or is terminated for cause prior to March 17, 2017.

(11) Represents relocation expenses incurred in fiscal 2014.

(12) Mr. Yelamanchili received a prorated salary of $281,345 based on his period of employment as our Execu-

tive Vice President and General Manager, Enterprise Security in fiscal 2015. His annual base salary is

$700,000.

(13) Represents half of a one-time sign-on bonus of $1,000,000 as an inducement to accept our offer of

employment. Mr. Yelamanchili received $500,000 on March 31, 2015 and will receive the other $500,000

on August 31, 2015, provided that he does not voluntarily leave our company or is terminated for cause

prior to August 31, 2015.

(14) Represents (a) $8,281 for dividend equivalent payment on stock awards, and (b) $5,250 for the Company’s

contributions to Mr. Yelamanchili’s account under its 401(k) plan.

(15) This amount includes a prorated increase in base salary as part of Mr. Taylor’s annual review.

(16) Represents (a) $4,284 for coverage of expenses related to attendance at the FY14 sales achiever’s trip,

(b) $36,817 for dividend equivalent payment on stock awards, (c) $1,178 for membership fees, (d) $13,357

for reimbursement for tax services, and (e) $7,688 for the Company’s contributions to Mr. Taylor’s account

under its 401(k) plan.

(17) Represents (a) $7,350 for dividend equivalent payment on stock awards, (b) $1,121 for membership fees,

(c) $13,971 for reimbursement for tax services, and (d) $6,000 for the Company’s contributions to

Mr. Taylor’s account under its 401(k) plan.

(18) Represents the executive officer’s annual bonus under the Executive Annual Incentive Plan for fiscal 2013,

which was earned in fiscal 2013 and paid in fiscal 2014.

(19) Represents (a) $959 for coverage of expenses related to attendance at the FY12 Board retreat, (b) $1,111 for

membership fees, (c) $6,529 for reimbursement for tax services, and (d) $6,000 for the Company’s con-

tributions to Mr. Taylor’s account under its 401(k) plan.

(20) Mr. Rosch received a prorated salary of $435,923 based on his period of employment as our Executive Vice

President, Norton Business Unit in fiscal 2015. Mr. Rosch’s base annual salary increased from $400,000 to

$440,000 in July 2014 in connection with his promotion to our Executive Vice President, Norton Business

Unit.

(21) Represents (a) 12,145 for coverage of expenses related to attendance at the FY14 sales achiever’s trip,

(b) $32,030 for dividend equivalent payment on stock awards, (c) $2,070 for spousal medical benefits,

(d) $1,800 for reimbursement for tax services, (e) $6,800 for the Company’s contributions to Mr. Rosch’s

account under its 401(k) plan, and (f) $40 for an appreciation award.

(22) Represents salary paid through the effective date of Mr. Gillett’s termination on December 6, 2014.

(23) Represents (a) $65,002 for dividend equivalent payment on stock awards, (b) $28,669 for coverage of

expenses related to attendance at the FY14 sales achiever’s trip, and (c) $1,435,682 in cash severance pay

pursuant to our Executive Severance Plan. For more information regarding Mr. Gillett’s cash severance pay,

see “Potential Payments Upon Termination or Change in Control” below.

(24) Represents (a) $5,764 for dividend equivalent payment on stock awards, (b) $46,272 for coverage of

expenses related to attendance at the FY13 sales achiever’s trip, and (c) $266,643 for relocation expenses.

(25) Mr. Gillett received a prorated salary of $241,951 based on his period of employment as our Executive Vice

President and Chief Operating Officer in fiscal 2013. His annual base salary is $875,000.

(26) Represents two one-time sign-on bonuses designed to partially offset Mr. Gillett’s forfeiture of various

bonuses, including $2,552,000 of previously-paid bonuses that he was obligated to repay in full, as a result

of his departure from his former employer. Mr. Gillett was obligated to repay all or a portion of these sign-

on bonuses if he voluntarily left the Company or was terminated for cause prior to December 21, 2017.

52