Symantec 2015 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2015 compared to 2014:

Sales and marketing expense decreased $116 million primarily due to lower OEM royalty fees of $130

million.

Research and development expense increased $105 million primarily due to higher salaries and wages of

$34 million, higher equipment costs of $12 million, an increase in information technology and telecom costs of

$11 million, and an increase in stock-based compensation of $17 million.

General and administrative expenses decreased $67 million primarily due to a reduction of outside services

of $63 million.

Amortization of intangible assets decreased $48 million primarily as a result of various customer

relationship intangibles becoming fully amortized at the end of the first quarter of fiscal 2014.

Restructuring, separation, and transition costs include severance, facilities, separation, transition and other

related costs. For fiscal 2015, we incurred $125 million of restructuring costs, $81 million in separation costs,

and $46 million in transition costs. For further information on restructuring, separation, and transition costs, see

Note 6 of the Notes to Consolidated Financial Statements in this annual report.

We experienced favorable foreign currency effects on our operating expenses of $66 million in fiscal 2015

as compared to fiscal 2014.

2014 compared to 2013:

Sales and marketing expense decreased $350 million in fiscal 2014, primarily due to lower salaries and

wages of $188 million resulting from lower headcount, and lower advertising and promotion expenses of $146

million. Our sales and marketing expense in fiscal 2014 was also impacted by the changes in our go-to-market

strategy as described under Part I, Item 1. Business, “Sales and Go-To-Market-Strategy.”

The $13 million increase in research and development expense for fiscal 2014 was primarily due to higher

equipment costs.

Amortization of intangible assets decreased by $130 million primarily as a result of various customer

relationship intangibles becoming fully amortized at the end of the first quarter of fiscal 2014.

Restructuring and transition costs consist of severance, facilities, transition and other related costs

associated with our organization simplification. For fiscal 2014, we recognized $212 million of restructuring, $49

million in transition costs related to our ERP system and $3 million in other transition costs. For further

information on restructuring and transition costs, see Note 6 of the Notes to Consolidated Financial Statements in

this annual report.

We experienced favorable foreign currency effects on our operating expenses of $42 million in fiscal 2014

as compared to fiscal 2013.

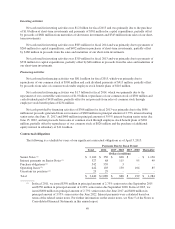

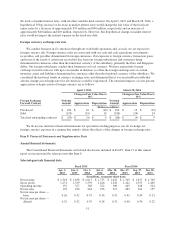

Non-operating expense, net by fiscal year

Change in %

2015 2014 2013 2015 v 2014 2014 v 2013

(Dollars in millions)

Interest income $ 12 $ 12 $ 12 -% -%

Interest expense (79) (84) (139) (6)% (40)%

Other income, net 11 45 27 (76)% 67%

Non-operating expense, net $ (56) $ (27) $ (100) 107% (73)%

44