Symantec 2015 Annual Report Download - page 147

Download and view the complete annual report

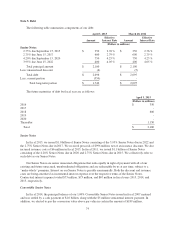

Please find page 147 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.short collection terms, and the geographical dispersion of sales transactions. We maintain reserves for potential

credit losses and such losses have been within management’s expectations. See Note 9 for details of significant

customers.

Advertising and other promotional costs

Advertising and other promotional costs are charged to operations as incurred and included in operating

expenses. These costs totaled $330 million, $451 million, and $594 million for fiscal 2015, 2014, and 2013,

respectively.

Contingencies

We evaluate contingent liabilities including threatened or pending litigation in accordance with the

authoritative guidance on contingencies. We assess the likelihood of any adverse judgments or outcomes from

potential claims or proceedings, as well as potential ranges of probable losses, when the outcomes of the claims

or proceedings are probable and reasonably estimable. A determination of the amount of accrued liabilities

required, if any, for these contingencies is made after the analysis of each separate matter. Because of

uncertainties related to these matters, we base our estimates on the information available at the time of our

assessment. As additional information becomes available, we reassess the potential liability related to our

pending claims and litigation and may revise our estimates. Any revisions in the estimates of potential liabilities

could have a material impact on our operating results and financial position.

Sales Commissions

Sales commissions that are incremental and directly related to customer sales contracts in which revenue is

deferred are accrued and capitalized upon execution of a non-cancelable customer contract, and subsequently

expensed over the term of such contract in proportion to the related future revenue streams. For commission costs

where revenue is recognized, the related commission costs are recorded in the period of revenue recognition.

Recently issued authoritative guidance

On April 10, 2014, the Financial Accounting Standards Board (“FASB”) issued Accounting Standards

Update No. 2014-08, Presentation of Financial Statements and Property, Plant and Equipment, that provides new

guidance related to reporting discontinued operations. This new standard raises the threshold for a disposal to

qualify as a discontinued operation and requires new disclosures of both discontinued operations and certain

other disposals that do not meet the definition of a discontinued operation. The new standard is effective for the

Company April 4, 2015, and will apply to the treatment of the planned separation of our information

management business that is expected to occur on January 2, 2016. Early adoption is permitted but only for

disposals that have not been reported in financial statements previously issued. We do not expect that this

standard will have a material impact on our Consolidated Financial Statements and related disclosures.

On May 28, 2014, the FASB issued Accounting Standards Update No. 2014-09, Revenue from Contracts

with Customers, that requires an entity to recognize the amount of revenue to which it expects to be entitled for

the transfer of promised goods or services to customers, and will replace most existing revenue recognition

guidance in U.S. GAAP. The new standard is effective for the Company April 1, 2017. The standard permits the

use of either the retrospective or cumulative effect transition method. On April 29, 2015, the FASB proposed a

one year deferral in the effective date of the new standard. We are evaluating the effect that the standard will

have on our Consolidated Financial Statements and related disclosures. We have not yet selected a transition

method nor have we determined the effect of the standard on our ongoing financial reporting.

On April 7, 2015, the FASB issued Accounting Standards Update No. 2015-03, Interest-Imputation of

Interest, which requires debt issuance costs to be presented as a direct deduction from the carrying amount of the

69