Symantec 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Senior Notes. In fiscal 2013, we issued $1.0 billion of Senior Notes consisting of the 3.95% Senior Notes

due in 2022 and the 2.75% Senior Notes due in 2017. We received proceeds of $996 million, net of an issuance

discount. In fiscal 2011, we issued $1.1 billion of Senior Notes consisting of the 4.20% Senior Notes due in 2020

and 2.75% Senior Notes due in 2015.

Revolving Credit Facility. In fiscal 2011, we entered into a $1.0 billion senior unsecured revolving credit

facility (“credit facility”), which was amended in fiscal 2013. The amendment extended the term of the credit

facility to June 7, 2017. Under the terms of this credit facility, we must comply with certain financial and non-

financial covenants, including a covenant to maintain a specified ratio of debt to EBITDA (earnings before

interest, taxes, depreciation and amortization). As of April 3, 2015, we were in compliance with the required

covenants, and no amounts were outstanding.

We believe that our existing cash and investment balances, our available revolving credit facility, our ability

to issue new debt instruments, and cash generated from operations will be sufficient to meet our working capital

and capital expenditure requirements, as well as to fund any cash dividends, principal and interest payments on

debt, and repurchases of our stock, for at least the next 12 months and foreseeable future. Since the beginning of

fiscal 2014, we have implemented a capital allocation strategy pursuant to which we expect to return over time

approximately 50% of free cash flow to stockholders through a combination of dividends and share repurchases,

while still enabling our company to invest in its future. Our strategy emphasizes organic growth through internal

innovation and will be complemented by acquisitions that fit strategically and meet specific internal profitability

hurdles.

Uses of Cash

Our principal cash requirements include working capital, capital expenditures, payments of principal and

interest on debt, and payments of taxes. Also, we may, from time to time, engage in the open market purchase of

our notes prior to their maturity. Furthermore, our capital allocation strategy contemplates a quarterly cash

dividend. In addition, we regularly evaluate our ability to repurchase stock, pay debts, and acquire other

businesses.

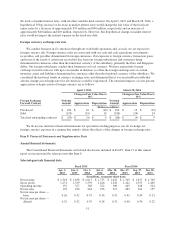

Stock Repurchases. Our Board of Directors authorized a new $1.0 billion stock repurchase program during

the fourth quarter of fiscal 2015. In fiscal 2015, we repurchased 21 million shares, or $500 million of our

common stock. In fiscal 2014, we repurchased 21 million shares, or $500 million, of our common stock. In fiscal

2013, we repurchased 49 million shares, or $826 million, of our common stock. Our active stock repurchase

programs have $1.2 billion remaining authorized for future repurchase as of April 3, 2015, with no expiration

date.

Dividend Program. During fiscal 2015, we declared and paid aggregate cash dividends of $413 million or

$0.60 per common share. During fiscal 2014, we declared and paid cash dividends of $418 million or $0.60 per

common share. Our restricted stock and performance-based stock units have dividend equivalent rights entitling

holders to dividend equivalents to be paid in the form of cash upon vesting, for each share of the underlying

units. No dividends or dividend equivalents were paid in any periods prior to fiscal 2014.

On May 14, 2015, we declared a cash dividend of $0.15 per share of common stock to be paid on June 24,

2015 to all stockholders of record as of the close of business on June 10, 2015. All shares of common stock

issued and outstanding, and unvested restricted stock and performance-based stock, as of the record date will be

entitled to the dividend and dividend equivalents, respectively. Any future dividends and dividend equivalents

will be subject to the approval of our Board of Directors.

Restructuring Plans. In fiscal 2015, we announced plans to separate our business into two independent

publicly-traded companies: one focused on security and one focused on information management. We expect to

complete the legal separation on January 2, 2016, subject to market, regulatory and certain other conditions. In

47