Symantec 2015 Annual Report Download - page 53

Download and view the complete annual report

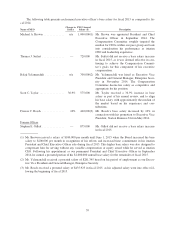

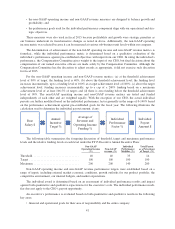

Please find page 53 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Our 2013 Equity Incentive Plan (the “2013 Plan”) provides for the award of stock options, stock apprecia-

tion rights, restricted stock, and restricted stock units (including PRUs). For fiscal 2015, the equity incentive

component of our executive compensation program consisted of PRUs and RSUs for all of our named executive

officers, except for Mr. Yelamanchili who received RSUs only for his new hire grant due to his start date with us

which was more than halfway through the first year of the three-year performance period under the PRUs granted

for fiscal 2015. We also offer all employees the opportunity to participate in the 2008 Employee Stock Purchase

Plan, which allows for the purchase of our stock at a discount to the fair market value through payroll deductions.

This plan is designed to comply with Section 423 of the Code. During fiscal 2015, two of the named executive

officers participated in the 2008 Employee Stock Purchase Plan.

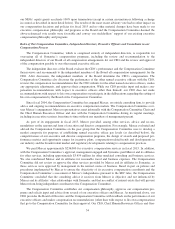

We seek to provide equity incentive awards that are competitive with companies in our peer group and the

other information technology companies that the Compensation Committee includes in its competitive market

assessment. As such, we establish target equity incentive award grant guideline levels for the named executive

officers based on competitive market assessments. When making annual equity awards to named executive offi-

cers, we consider corporate results during the past year, the role, responsibility and performance of the individual

named executive officer, the competitive market assessment described above, prior equity awards, and the level

of vested and unvested equity awards then held by each named executive officer. In making equity awards, we

also generally take into consideration gains recognizable by the executive from equity awards made in prior

years. Mercer provides the Compensation Committee with market data on these matters, as well as providing to

the Compensation Committee summaries of the prior grants made to the individual named executive officers.

As discussed below, the Compensation Committee believes that for fiscal 2015, a mix of PRUs and time-

vested RSUs is the appropriate long-term equity incentive for named executive officers. For fiscal 2015, approx-

imately 75% of our CEO’s equity incentive award value was granted in the form of PRUs and approximately

25% in the form of RSUs, reflecting our philosophy to allocate a significantly larger portion of the value of the

CEO’s target total long-term equity incentive award in the form of PRUs than time-vested RSUs. While our phi-

losophy is to allocate an equal target value of PRUs and RSUs to our other named executive officers, on average

33% of the other named executive officers’ equity incentive award value was granted in the form of PRUs and

approximately 67% in the form of RSUs due to the impact of new hire RSU grants and additional RSU granted to

promote retention as described below.

Restricted Stock Units (RSUs): RSUs represent the right to receive one share of Symantec common stock

for each RSU vested upon the settlement date, which is the date on which certain conditions, such as continued

employment with us for a pre-determined length of time, are satisfied. The Compensation Committee believes

that RSUs align the interests of the named executive officers with the interests of our stockholders because the

value of these awards appreciates if the trading price of our common stock appreciates, and these awards also

have retention value even during periods in which our trading price does not appreciate, which supports con-

tinuity in the senior management team.

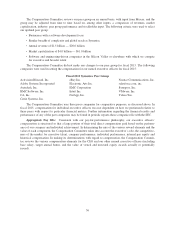

Shares of our stock are issued to RSU holders as the awards vest. The vesting schedule for regular RSUs

granted to our named executive officers in fiscal 2015 as part of the annual review process provide that each

award vests in four equal annual installments. In fiscal 2015, we awarded additional RSU grants to three execu-

tive officers, reflecting the Compensation Committee’s desire to retain these executive officers in a competitive

environment. Mr. Taylor’s and Mr. Gillett’s retention-based RSU grants vest in two equal annual installments

from the grant date of June 2014. Mr. Seifert’s retention-based RSU grant vests 50% after approximately two

years from the grant date and in two equal annual installments thereafter. The Compensation Committee granted

Mr. Yelamanchili’s a new hire RSU grant in an amount designed to help make him whole for the value of equity

he forfeited at his former employer. This new hire RSU grant vested 20% in March 2015 and will vest as to 50%

in December 2015 and as to the remainder in two equal annual installments in December 2016 and December

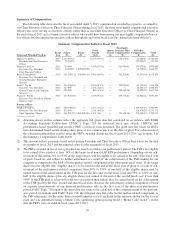

2017. (Details of RSUs granted to the named executive officers in fiscal 2015 are disclosed in the Summary

Compensation Table and Grants of Plan-Based Awards table on pages 50 and 53, respectively.)

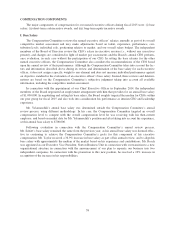

Performance-based Restricted Stock Units (PRUs): The Compensation Committee grants PRUs in fur-

therance of our pay for performance philosophy. Our Compensation Committee established this program to

enhance our pay-for-performance culture with a component directly linked to our total stockholder return over

43