Symantec 2015 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

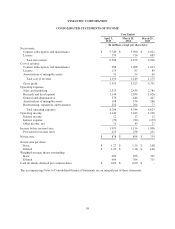

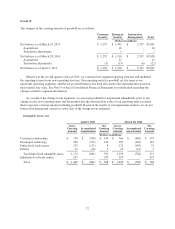

The following table summarizes the allowances for doubtful accounts for the periods presented:

April 3,

2015

March 28,

2014

March 29,

2013

(Dollars in millions)

Beginning balance $ 7 $ 5 $ 5

Provision for doubtful accounts 7 6 3

Deductions, net (7) (4) (3)

Ending balance $ 7 $ 7 $ 5

Property and equipment

Property, equipment, and leasehold improvements are stated at cost, net of accumulated depreciation. We

capitalize costs incurred during the application development stage related to the development of internal use

software and enterprise cloud computing services. We expense costs incurred related to the planning and post-

implementation phases of development as incurred. Depreciation is provided on a straight-line basis over the

estimated useful lives. Estimated useful lives for financial reporting purposes are as follows: buildings, 20 to

30 years; leasehold improvements, the lesser of the life of the improvement or the initial lease term; computer

hardware and software, and office furniture and equipment, 3 to 5 years.

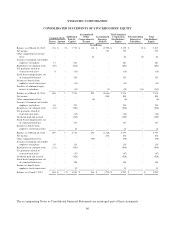

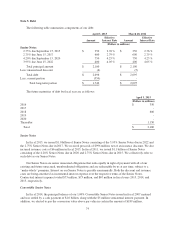

The following table summarizes property and equipment, net of accumulated depreciation by categories for

the periods presented:

April 3,

2015

March 28,

2014

(Dollars in millions)

Land $ 79 $ 79

Computer hardware and software 1,188 1,797

Office furniture and equipment 102 140

Buildings 542 539

Leasehold improvements 288 356

Construction in progress 80 28

2,279 2,939

Accumulated depreciation (1,074) (1,823)

Property and equipment, net $ 1,205 $ 1,116

Depreciation expense was $280 million, $281 million, and $283 million in fiscal 2015, 2014, and 2013,

respectively.

Business combinations

We use the acquisition method of accounting under the authoritative guidance on business combinations.

Each acquired company’s operating results are included in our consolidated financial statements starting on the

date of acquisition. The purchase price is equivalent to the fair value of consideration transferred. Tangible and

identifiable intangible assets acquired and liabilities assumed as of the date of acquisition are recorded at their

estimated fair values at acquisition date. Goodwill is recognized for the excess of purchase price over the net fair

value of assets acquired and liabilities assumed.

Goodwill and intangible assets

Goodwill. Goodwill represents the excess of the purchase price of the acquisition over the net fair value of

assets acquired and liabilities assumed. We assign goodwill to our reporting units based on the relative fair value

at acquisition date. We review goodwill for impairment for each reporting unit on an annual basis during the

66