Symantec 2015 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

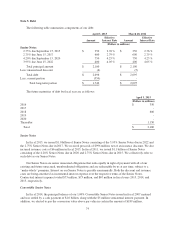

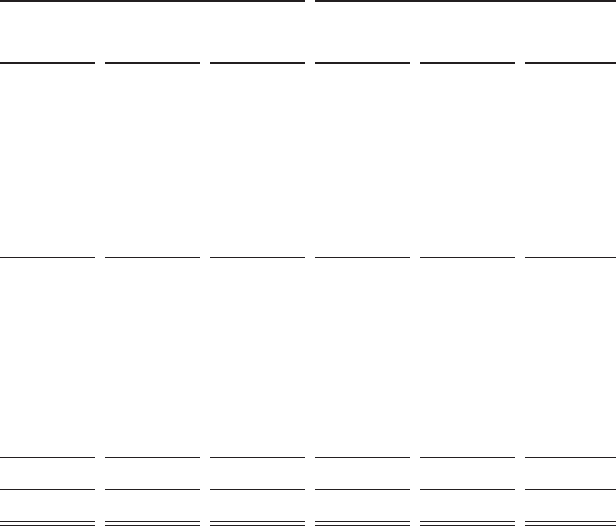

There have been no transfers between fair value measurement levels during fiscal 2015. The following table

summarizes our assets measured at fair value on a recurring basis, by level, within the fair value hierarchy:

April 3, 2015 March 28, 2014

Fair value

Cash and

cash

equivalents

Short-term

investments Fair value

Cash and

cash

equivalents

Short-term

investments

(Dollars in millions)

Cash $ 807 $ 807 $ - $ 922 $ 922 $ -

Non-negotiable certificates of

deposit 296 260 36 405 365 40

Level 1

Money market 1,725 1,725 - 2,380 2,380 -

U.S. government securities 284 - 284 95 - 95

Marketable equity securities 5 - 5 6 - 6

2,014 1,725 289 2,481 2,380 101

Level 2

Corporate bonds 166 - 166 123 3 120

U.S. agency securities 68 - 68 45 - 45

Commercial paper 333 82 251 56 32 24

Negotiable certificates of deposit 184 - 184 - - -

International government

securities 23 - 23 52 5 47

774 82 692 276 40 236

Total $ 3,891 $ 2,874 $ 1,017 $ 4,084 $ 3,707 $ 377

Fair Value of Debt

As of April 3, 2015 and March 28, 2014, the fair value of our current and long-term debt was $2.2 billion

based on Level 2 inputs.

Note 3. Goodwill and Intangible Assets

During fiscal 2015, 2014, and 2013 we completed business acquisitions primarily to enhance our technology

portfolio for aggregate cash consideration, net of cash acquired, of $19 million, $17 million, and $28 million,

respectively. The results of operations related to these acquisitions have been included in our consolidated

statements of income from the acquisition date. Pro forma results of operations have not been presented because

the acquisitions were not material to our results of operations.

We also acquired rights to certain technology for $20 million in an asset acquisition during the third quarter

of fiscal 2015. The total amount assigned to acquired finite-lived intangible assets from fiscal 2015 acquisitions

was $27 million. This cost was assigned to developed technology and is being amortized to cost of revenue on a

straight-line basis over the weighted-average useful life of 3.5 years. Goodwill related to the business

acquisitions is summarized in the following table.

71