Symantec 2015 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For further information on the impact of foreign earnings on our effective tax rate, see Note 11 of the Notes

to Consolidated Financial Statements in this annual report.

See Critical Accounting Policies and Estimates above for additional information about our provision for

income taxes.

In assessing the ability to realize our deferred tax assets, we considered whether it is more likely than not

that some portion or all the deferred tax assets will not be realized. We considered the following: we have

historical cumulative book income, as measured by the current and prior two years; we have strong, consistent

taxpaying history; we have substantial U.S. federal income tax carryback potential; and we have substantial

amounts of scheduled future reversals of taxable temporary differences from our deferred tax liabilities. Levels of

future taxable income are subject to the various risks and uncertainties discussed in Part I, Item 1A, Risk Factors,

set forth in this annual report. We have concluded that this positive evidence outweighs the negative evidence

and, thus, that the deferred tax assets as of April 3, 2015 of $350 million, which are net of a valuation allowance

of $60 million, are realizable on a “more likely than not” basis.

In fiscal 2013, we resolved an IRS audit for the Veritas 2002 through 2005 tax years and executed the final

closing agreement. Accordingly, we recorded a further tax benefit of $3 million in fiscal 2013 based on the

closing agreement. We also amended our state tax returns for the Veritas 2002 through 2005 tax years in fiscal

2013 to reflect the adjustments in the closing agreement and remeasured our state liability resulting in a benefit

of $7 million.

On September 3, 2013, we settled and effectively settled matters with the IRS for the Symantec 2005

through 2008 fiscal years. The result of the settlements, effective settlements, and re-measurements resulted in a

reduction in the balance of our gross unrecognized tax benefits in fiscal year 2014 of $122 million.

On March 18, 2015, we settled and effectively settled matters with the IRS for the Symantec 2009 through

2013 fiscal years. The settlement and effective settlement resulted in a benefit to tax expense in fiscal year 2015

of $59 million. Additionally, the Company settled transfer price related matters of $158 million, a portion of

which was accounted for against deferred tax liabilities on unremitted foreign earnings. The Company has paid in

$155 million to cover the final tax and interest liability on the settlement.

The timing of the resolution of income tax examinations is highly uncertain, and the amounts ultimately

paid, if any, upon resolution of the issues raised by the taxing authorities may differ materially from the amounts

accrued for each year. Although potential resolution of uncertain tax positions involve multiple tax periods and

jurisdictions, it is reasonably possible that the gross unrecognized tax benefits related to these audits could

decrease (whether by payment, release, or a combination of both) in the next 12 months by $44 million.

We continue to monitor the progress of ongoing income tax controversies and the impact, if any, of the

expected tolling of the statute of limitations in various taxing jurisdictions.

LIQUIDITY AND CAPITAL RESOURCES

Sources of Cash

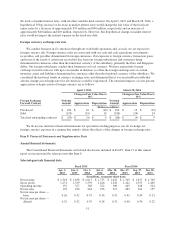

We have historically relied on cash flow from operations, borrowings under a credit facility, and issuances

of debt and equity securities for our liquidity needs. As of April 3, 2015, we had cash, cash equivalents and short-

term investments of $3.9 billion and an unused credit facility of $1.0 billion resulting in a liquidity position of

approximately $4.9 billion. As of April 3, 2015, $2.2 billion in cash, cash equivalents, and short-term

investments were held by our foreign subsidiaries. We have provided U.S. deferred taxes on a portion of our

undistributed foreign earnings sufficient to address the incremental U.S. tax that would be due if we needed such

portion of these funds to support our operations in the U.S.

46