Symantec 2015 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.fourth quarter of the fiscal year or more frequently if facts and circumstances warrant. During the annual

impairment reviews in fiscal 2015, 2014 and 2013, we evaluated qualitative factors to assess the likelihood of

impairment and determined that were no indicators of significant risk of goodwill impairment. Consequently, we

did not recognize any goodwill impairment charges in fiscal 2015, 2014 or 2013.

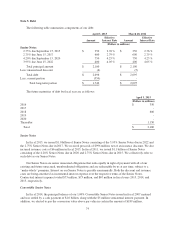

Intangible assets. In connection with our acquisitions, we generally recognize assets for customer

relationships, developed technology, finite-lived trade names, patents, and indefinite-lived trade names. Finite-

lived intangible assets are carried at cost less accumulated amortization. Such amortization is provided on a

straight-line basis over the estimated useful lives of the respective assets, generally from 1 to 11 years.

Amortization for developed technology is recognized in cost of revenue. Amortization for customer relationships

and certain trade names is recognized in operating expenses. Indefinite-lived intangible assets are not subject to

amortization but instead tested for impairment annually or more frequently if events or changes in circumstances

indicate that the carrying amount of an asset may not be recoverable. Recoverability of indefinite-lived intangible

assets is measured by the comparison of the carrying amount of the asset to the discounted future cash flows of

the asset is expected to generate. If the carrying amount of the asset exceeds its discounted future cash flows, an

impairment loss is recognized for the difference between the asset’s carrying amount and fair value.

Restructuring

Restructuring actions generally include significant actions involving employee-related severance charges

and contract termination costs. Employee-related severance charges are largely based upon substantive severance

plans, while some are mandated requirements in certain foreign jurisdictions. These charges are reflected in the

period when both the actions are probable and the amounts are estimable. Separation and other related costs

include advisory, consulting and other costs incurred in connection with the separation of our information

management business. Contract termination costs for leased facilities primarily reflect costs that will continue to

be incurred under the contract for its remaining term without economic benefit to the Company. These charges

are reflected in the period when the facility ceases to be used.

Income taxes

The provision for income taxes is computed using the asset and liability method, under which deferred tax

assets and liabilities are recognized for the expected future tax consequences of temporary differences between

the financial reporting and tax bases of assets and liabilities, and for operating loss and tax credit carryforwards

in each jurisdiction in which we operate. Deferred tax assets and liabilities are measured using the currently

enacted tax rates that apply to taxable income in effect for the years in which those tax assets are expected to be

realized or settled. We record a valuation allowance to reduce deferred tax assets to the amount that is believed

more likely than not to be realized.

We are required to compute our income taxes in each federal, state, and international jurisdiction in which

we operate. This process requires that we estimate the current tax exposure as well as assess temporary

differences between the accounting and tax treatment of assets and liabilities, including items such as accruals

and allowances not currently deductible for tax purposes. The income tax effects of the differences we identify

are classified as current or long-term deferred tax assets and liabilities in our Consolidated Balance Sheets. Our

judgments, assumptions, and estimates relative to the current provision for income tax take into account current

tax laws, our interpretation of current tax laws, and possible outcomes of current and future audits conducted by

foreign and domestic tax authorities. Changes in tax laws or our interpretation of tax laws and the resolution of

current and future tax audits could significantly impact the amounts provided for income taxes in our

Consolidated Balance Sheets and Consolidated Statements of Income. We must also assess the likelihood that

deferred tax assets will be realized from future taxable income and, based on this assessment, establish a

valuation allowance, if required. Our determination of our valuation allowance is based upon a number of

assumptions, judgments, and estimates, including forecasted earnings, future taxable income, and the relative

proportions of revenue and income before taxes in the various domestic and international jurisdictions in which

67