Symantec 2015 Annual Report Download - page 59

Download and view the complete annual report

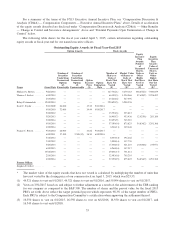

Please find page 59 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.decisions and retains the flexibility to grant awards or pay compensation the Compensation Committee

determines to be consistent with its goals for Symantec’s executive compensation program even if the awards

may not be deductible by Symantec for tax purposes.

Tax Implications for Officers. Section 409A of the Internal Revenue Code imposes additional income

taxes on executive officers for certain types of deferred compensation that do not comply with Section 409A. The

Company attempts in good faith to structure compensation so that it either conforms with the requirements of or

qualifies for an exception under Code Section 409A. Section 280G of the Internal Revenue Code imposes an

excise tax on payments to executives of severance or change of control compensation that exceed the levels

specified in the Section 280G rules. Our named executive officers could receive the amounts shown in the sec-

tion entitled “Potential Payments Upon Termination or Change in Control” (beginning on page 57 below) as

severance or change of control payments that could implicate this excise tax. As mentioned above, we do not

offer our officers as part of their change of control benefits any gross-ups related to this excise tax under Code

Section 4999.

Accounting Considerations. The Compensation Committee also considers the accounting and cash flow

implications of various forms of executive compensation. In its financial statements, the Company records sal-

aries and performance-based compensation incentives as expenses in the amount paid, or to be paid, to the named

executive officers. Accounting rules also require the Company to record an expense in its financial statements for

equity awards, even though equity awards are not paid as cash to employees. The accounting expense of equity

awards to employees is calculated in accordance with the requirements of FASB Accounting Standards Codifica-

tion Topic 718. The Compensation Committee believes, however, that the many advantages of equity compensa-

tion, as discussed above, more than compensate for the non-cash accounting expense associated with them.

Compensation Committee Interlocks and Insider Participation

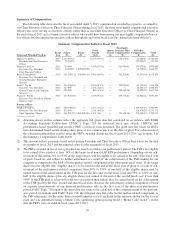

The members of the Compensation Committee during fiscal 2015 were Geraldine B. Laybourne, David L.

Mahoney, Robert S. Miller and Daniel H. Schulman. None of the members of the Compensation Committee in

fiscal 2015 were at any time during fiscal 2015 or at any other time an officer or employee of Symantec or any of

its subsidiaries, and none had or have any relationships with Symantec that are required to be disclosed under

Item 404 of Regulation S-K. None of Symantec’s executive officers has served as a member of the board of

directors, or as a member of the compensation or similar committee, of any entity that has one or more executive

officers who served on our Board of Directors or Compensation Committee during fiscal 2015.

Compensation Committee Report

The information contained in the following report of Symantec’s Compensation Committee is not considered

to be “soliciting material,” “filed” or incorporated by reference in any past or future filing by Symantec under

the Securities Exchange Act of 1934 or the Securities Act of 1933 unless and only to the extent that Symantec

specifically incorporates it by reference.

The Compensation Committee has reviewed and discussed with management the Compensation Discussion

and Analysis (“CD&A”) contained in this proxy statement. Based on this review and discussion, the Compensa-

tion Committee has recommended to the Board that the CD&A be included in this proxy statement and our

Annual Report on Form 10-K for the fiscal year ended April 3, 2015.

By: The Compensation and Leadership Development Committee of the Board of Directors:

Geraldine B. Laybourne

Robert S. Miller (Chair)

David L. Mahoney

Daniel H. Schulman

49