Symantec 2015 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

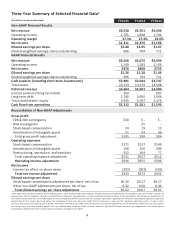

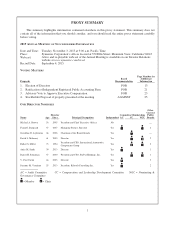

Three Year Summary of Selected Financial Data1

($ in millions, except per share data)

FY2015 FY2014 FY2013

Non-GAAP Financial Results

Net revenue $6,538 $6,701 $6,906

Operating income 1,785 1,838 1,702

Operating margin 27.3% 27.4% 24.6%

Net income $1,311 $1,370 $1,186

Diluted earnings per share $1.88 $1.95 $1.67

Diluted weighted-average shares outstanding 696 704 711

GAAP Financial Results

Net revenue $6,508 $6,676 $6,906

Operating income 1,149 1,183 1,106

Net income $878 $898 $755

Diluted earnings per share $1.26 $1.28 $1.06

Diluted weighted-average shares outstanding 696 704 711

Cash position (including short-term investments) $3,891 $4,084 $4,747

Total assets 13,233 13,539 14,508

Deferred revenue $3,664 $3,903 $4,080

Current portion of long-term debt 350 - 997

Long-term debt 1,746 2,095 2,094

Total stockholders’ equity 5,935 5,797 5,476

Cash flow from operations $1,312 $1,281 $1,593

Reconciliation of Non-GAAP Adjustments

Gross profit

EDS & NDI contingency $30 $ - $ -

GSA investigation - 25 -

Stock-based compensation 24 19 15

Amortization of intangible assets 51 54 69

Total gross profit adjustment $105 $98 $84

Operating expenses

Stock-based compensation $171 $137 $149

Amortization of intangible assets 108 156 286

Restructuring, separation, and transition 252 264 77

Total operating expense adjustment $531 $557 $512

Operating income adjustment $636 $655 $596

Net income

Income tax effect on above items (203) (183) (165)

Total net Income adjustment $433 $472 $431

Diluted earnings per share

Stock-based compensation adjustment per share, net of tax $0.20 $0.17 $0.17

Other non-GAAP adjustments per share, net of tax 0.42 0.50 0.44

Total diluted earnings per share adjustment $0.62 $0.67 $0.61

1Non-GAAP financial measures adjust for the following items: stock-based compensation expense; charges related to the amortization of intangible assets; certain other income and

expense items that management considers unrelated to the Company’s core operations; and the associated income tax effects of the adjustments. We believe our presentation of

non-GAAP financial measures, when taken together with corresponding GAAP financial measures, provides meaningful supplemental information regarding the Company’s operating

performance for the reasons discussed below. Our management team uses these non-GAAP financial measures in assessing the Company’s operating results, as well as when

planning, forecasting and analyzing future periods. We believe that these non-GAAP financial measures also facilitate comparisons of the Company’s performance to prior periods

and to our peers and that investors benefit from an understanding of the non-GAAP financial measures. Non-GAAP financial measures are supplemental and should not be

considered a substitute for financial information presented in accordance with GAAP.

4