Symantec 2015 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

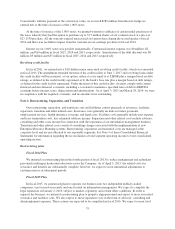

The principal components of deferred tax assets are as follows:

Year Ended

April 3,

2015

March 28,

2014

(Dollars in millions)

Deferred tax assets:

Tax credit carryforwards $ 31 $ 38

Net operating loss carryforwards of acquired companies 57 79

Other accruals and reserves not currently tax deductible 173 128

Deferred revenue 74 92

Loss on investments not currently tax deductible 16 16

State income taxes 14 19

Stock-based compensation 45 31

Gross deferred tax assets 410 403

Valuation allowance (60) (56)

Deferred tax assets, net of valuation allowance $ 350 $ 347

Deferred tax liabilities:

Property and equipment (88) (76)

Goodwill (54) (29)

Intangible assets (24) (48)

Unremitted earnings of foreign subsidiaries (273) (399)

Prepaids and deferred expenses (42) (30)

Other — (7)

Total deferred tax liabilities $ (481) $ (589)

Net deferred tax assets (liabilities) $ (131) $ (242)

The valuation allowance provided against our deferred tax assets as of April 3, 2015 is mainly attributable to

net operating loss and tax credit carryforwards of acquired companies, state tax credits, and net operating losses

in foreign jurisdictions. The valuation allowance increased by a net of $4 million in fiscal 2015 due to changes in

corresponding deferred tax assets primarily related to state tax credit carryforwards.

As of April 3, 2015, we have U.S. federal net operating losses attributable to various acquired companies of

approximately $60 million, which, if not used, will expire between fiscal 2018 and 2032. These net operating loss

carryforwards are subject to an annual limitation under Internal Revenue Code §382, but are expected to be fully

realized. Furthermore, we have U.S. state net operating loss and credit carryforwards attributable to various

acquired companies of approximately $161 million and $39 million, respectively. If not used, our U.S. state net

operating losses will expire between fiscal 2016 and 2032 and the majority of our U.S. state credit carryforwards

can be carried forward indefinitely. In addition, we have foreign net operating loss carryforwards attributable to

various acquired foreign companies of approximately $183 million net of valuation allowances, the majority of

which, under current applicable foreign tax law, can be carried forward indefinitely.

In assessing the ability to realize our deferred tax assets, we considered whether it is more likely than not

that some portion or all the deferred tax assets will not be realized. We considered the following: we have

historical cumulative book income, as measured by the current and prior two years; we have strong, consistent

taxpaying history; we have substantial U.S. federal income tax carryback potential; and we have substantial

amounts of scheduled future reversals of taxable temporary differences from our deferred tax liabilities. We have

concluded that this positive evidence outweighs the negative evidence and, thus, that the deferred tax assets as of

April 3, 2015 are realizable on a “more likely than not” basis.

85