Symantec 2015 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

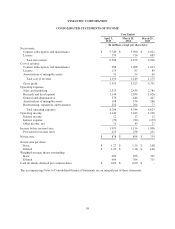

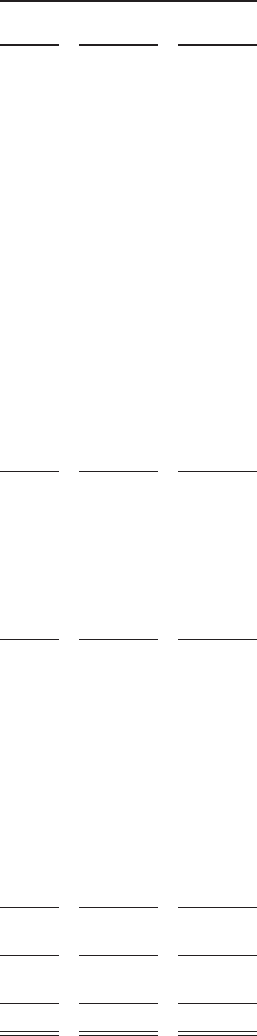

SYMANTEC CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

Year Ended

April 3,

2015

March 28,

2014

March 29,

2013

(Dollars in millions)

OPERATING ACTIVITIES:

Net income $ 878 $ 898 $ 755

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation 280 281 283

Amortization of intangible assets 159 210 355

Amortization of debt issuance costs and discounts 4 7 60

Stock-based compensation expense 195 156 164

Deferred income taxes (23) 47 31

Excess income tax benefit from the exercise of stock options (10) (17) (11)

Net gain from sale of short-term investments - (32) -

Other 10 8 16

Net change in assets and liabilities, excluding effects of acquisitions:

Trade accounts receivable, net (38) 30 (107)

Deferred commissions (30) 26 17

Accounts payable (65) (75) 33

Accrued compensation and benefits 49 (58) 12

Deferred revenue 19 (223) 119

Income taxes payable (191) 7 (31)

Other assets 22 (11) (64)

Other liabilities 53 27 (39)

Net cash provided by operating activities 1,312 1,281 1,593

INVESTING ACTIVITIES:

Purchases of property and equipment (381) (260) (336)

Payments for acquisitions, net of cash acquired, and purchases of intangibles (39) (17) (28)

Purchases of short-term investments (1,758) (492) -

Proceeds from maturities of short-term investments 681 117 45

Proceeds from sales of short-term investments 343 69 1

Other - - (1)

Net cash used in investing activities (1,154) (583) (319)

FINANCING ACTIVITIES:

Repayments of debt and other obligations (21) (1,189) -

Proceeds from convertible note hedge - 189 -

Net proceeds from sales of common stock under employee stock benefit plans 116 234 281

Excess income tax benefit from the exercise of stock options 10 17 11

Tax payments related to restricted stock units (47) (45) (36)

Dividends paid, net (413) (418) -

Repurchases of common stock (500) (500) (826)

Purchase of additional equity interest in subsidiary - - (111)

Proceeds from debt issuance, net of discount - - 996

Debt issuance costs - - (7)

Proceeds from other financing, net 44 - -

Net cash (used in) provided by financing activities (811) (1,712) 308

Effect of exchange rate fluctuations on cash and cash equivalents (180) 36 (59)

Change in cash and cash equivalents (833) (978) 1,523

Beginning cash and cash equivalents 3,707 4,685 3,162

Ending cash and cash equivalents $ 2,874 $ 3,707 $ 4,685

Income taxes paid (net of refunds) $ 353 $ 224 $ 252

Interest expense paid $ 75 $ 79 $ 69

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.

61