Symantec 2015 Annual Report Download - page 153

Download and view the complete annual report

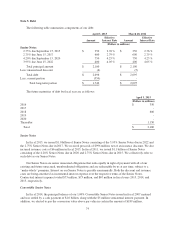

Please find page 153 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Concurrently with the payment of the conversion value, we received $189 million from the note hedge we

entered into at the time of issuance of the 1.00% notes.

At the time of issuance of the 1.00% notes, we granted warrants to affiliates of certain initial purchasers of

the notes whereby they had the option to purchase up to 52.7 million shares of our common stock at a price of

$27.1330 per share. All the warrants expired unexercised on various dates during the second quarter of fiscal

2014 and there was no dilutive impact from the warrants on our earnings per share for fiscal 2014.

Interest on our 1.00% notes was payable semiannually. Contractual interest expense was $0 million, $2

million, and $10 million in fiscal 2015, 2014 and 2013, respectively. Amortization of the debt discount was $0

million, $3 million and $55 million in fiscal 2015, 2014 and 2013, respectively.

Revolving credit facility

In fiscal 2011, we entered into a $1.0 billion senior unsecured revolving credit facility, which was amended

in fiscal 2013. The amendment extended the term of the credit facility to June 7, 2017 and revolving loans under

the credit facility will bear interest, at our option, either at a rate equal to a) LIBOR plus a margin based on debt

ratings, as defined in the credit facility agreement or b) the bank’s base rate plus a margin based on debt ratings,

as defined in the credit facility agreement. Under the terms of this credit facility, we must comply with certain

financial and non-financial covenants, including a covenant to maintain a specified ratio of debt to EBITDA

(earnings before interest, taxes, depreciation and amortization). As of April 3, 2015 and March 28, 2014, we were

in compliance with the required covenants, and no amounts were outstanding.

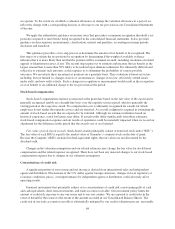

Note 6. Restructuring, Separation, and Transition

Our restructuring, separation, and transition costs and liabilities consist primarily of severance, facilities,

separation, transition and other related costs. Severance costs generally include severance payments,

outplacement services, health insurance coverage, and legal costs. Facilities costs generally include rent expense

and lease termination costs, less estimated sublease income. Separation and other related costs include advisory,

consulting and other costs incurred in connection with the separation of our information management business.

Transition and other related costs consist of consulting charges associated with the implementation of new

Enterprise Resource Planning systems. Restructuring, separation, and transition costs are managed at the

corporate level and are not allocated to our reportable segments. See Note 9 of these Consolidated Financial

Statements for information regarding the reconciliation of total segment operating income to total consolidated

operating income.

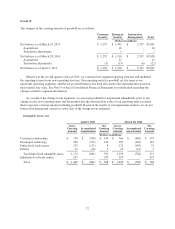

Restructuring plans

Fiscal 2014 Plan

We initiated a restructuring plan in the fourth quarter of fiscal 2013 to reduce management and redundant

personnel resulting in headcount reductions across the Company. As of April 3, 2015, the related costs for

severance and benefits are substantially complete; however, we expect to incur immaterial adjustments to

existing reserves in subsequent periods.

Fiscal 2015 Plan

In fiscal 2015, we announced plans to separate our business into two independent publicly-traded

companies: one focused on security and one focused on information management. We expect to complete the

legal separation on January 2, 2016, subject to market, regulatory and certain other conditions. In order to

separate the business, we initiated a restructuring plan to properly align personnel and expect to incur associated

severance and facilities costs. We also expect to incur separation costs in the form of advisory, consulting and

disentanglement expenses. These actions are expected to be completed in fiscal 2016. We expect to incur total

75