Symantec 2015 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

retainer payable to each director for serving as a member. Each director may elect any portion up to 100% of the

retainer to be paid in the form of stock. As of April 3, 2015, a total of 135,000 shares have been issued under this

plan and 65,000 shares remained available for future issuance.

2004 and 2013 Equity Incentive Plans

Under both the 2013 Equity Incentive Plan (“2013 Plan”) and the 2004 Equity Incentive Plan (“2004 Plan”)

(collectively “the Equity Plans”), the Company has granted incentive and nonqualified stock options, stock

appreciation rights, RSUs, restricted stock awards, and performance-based awards to employees, officers,

directors, consultants, independent contractors, and advisors to us. These may also be granted to any parent,

subsidiary, or affiliate of ours. The purpose of the Equity Plans has been to attract, retain, and motivate eligible

persons whose present and potential contributions are important to our success by offering them an opportunity

to participate in our future performance through equity awards. RSUs granted prior to November 2014 generally

vest over a four-year period, whereas RSUs granted thereafter generally vest over a three-year period.

Effective as of the first quarter of 2013, following Board of Directors’ approval, all RSUs and performance-

based awards granted under the Equity Plans have dividend equivalent rights (“DER”) which entitle participants

to the same dividend value per share as holders of Company’s Common Stock. The DER are to be paid in the

form of cash upon vesting for each share of the underlying award, and are subject to the same terms and

conditions as the underlying award.

Upon adoption, our stockholders approved and reserved 45 million shares of common stock for issuance

under the 2013 Plan. As of April 3, 2015, 24 million shares remained available for future grant. We use restricted

stock units as our primary equity awards and stock option activity is not material to the financial statements.

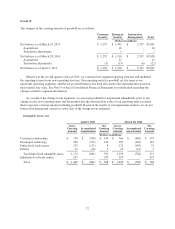

Stock-based compensation expense

The following table sets forth the total stock-based compensation expense recognized in our Consolidated

Statements of Income.

Year Ended

April 3,

2015

March 28,

2014

March 29,

2013

(In millions)

Cost of revenue $ 24 $ 19 $ 15

Sales and marketing 75 59 67

Research and development 65 48 50

General and administrative 31 30 32

Total stock-based compensation expense 195 156 164

Tax benefit associated with stock-based compensation expense (55) (45) (48)

Net stock-based compensation expense $ 140 $ 111 $ 116

82