Symantec 2015 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

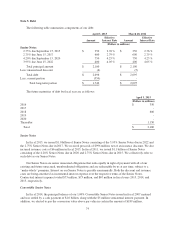

Note 5. Debt

The following table summarizes components of our debt:

April 3, 2015 March 28, 2014

Amount

Effective

Interest Rate Amount

Effective

Interest Rate

(Dollars in millions)

Senior Notes

2.75% due September 15, 2015 $ 350 2.76 % $ 350 2.76 %

2.75% due June 15, 2017 600 2.79 % 600 2.79 %

4.20% due September 15, 2020 750 4.25 % 750 4.25 %

3.95% due June 15, 2022 400 4.05 % 400 4.05 %

Total principal amount $ 2,100 $ 2,100

Less: unamortized discount (4) (5)

Total debt $ 2,096 $ 2,095

Less: current portion (350) -

Total long-term portion $ 1,746 $ 2,095

The future maturities of debt by fiscal year are as follows:

April 3, 2015

(Dollars in millions)

2016 $ 350

2017 -

2018 600

2019 -

2020 -

Thereafter 1,150

Total $ 2,100

Senior Notes

In fiscal 2013, we issued $1.0 billion of Senior Notes consisting of the 3.95% Senior Notes due in 2022 and

the 2.75% Senior Notes due in 2017. We received proceeds of $996 million, net of an issuance discount. We also

incurred issuance costs of $6 million in fiscal 2013. In fiscal 2011, we issued $1.1 billion of Senior Notes

consisting of the 4.20% Senior Notes due in 2020 and 2.75% Senior Notes due in 2015. We collectively refer to

such debt as our Senior Notes.

Our Senior Notes are senior unsecured obligations that rank equally in right of payment with all of our

existing and future unsecured, unsubordinated obligations and are redeemable by us at any time, subject to a

“make-whole” premium. Interest on our Senior Notes is payable semiannually. Both the discount and issuance

costs are being amortized as incremental interest expense over the respective terms of the Senior Notes.

Contractual interest expense totaled $73 million, $73 million, and $67 million in fiscal years 2015, 2014, and

2013, respectively.

Convertible Senior Notes

In fiscal 2014, the principal balance of our 1.00% Convertible Senior Notes issued in fiscal 2007 matured

and was settled by a cash payment of $1.0 billion, along with the $5 million semiannual interest payment. In

addition, we elected to pay the conversion value above par value in cash in the amount of $189 million.

74