Symantec 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

For further description of our operating segments see Note 9 of the Notes to Consolidated Financial

Statements in this annual report.

Financial results and trends

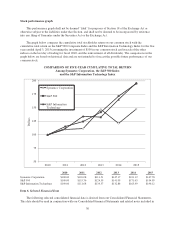

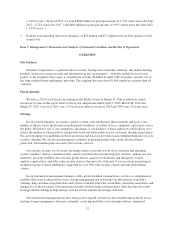

The following table provides an overview of key financial metrics for each of the last three fiscal years:

2015 2014 2013

(In millions, except percentages)

Consolidated Income Statement Data:

Total net revenue $ 6,508 $ 6,676 $ 6,906

Gross profit 5,355 5,527 5,731

Operating income 1,149 1,183 1,106

Operating margin percentage 18% 18% 16%

Consolidated Cash Flow and Balance Sheet Data:

Cash flow from operations 1,312 1,281 1,593

Deferred revenue 3,664 3,903 4,080

Total net revenue decreased $168 million for fiscal 2015 as compared to fiscal 2014, reflecting declines in

our content, subscription, and maintenance revenue, partially offset by an additional week from the 53-week

fiscal 2015 year and by increased license revenue. Content, subscription, and maintenance revenue decreased

$211 million primarily due to the general strengthening of the U.S. dollar against foreign currencies and declines

in our consumer security products driven by our channel strategy to exit certain high-cost OEM arrangements

and change our renewal practices. This was partially offset by increased revenue from Backup and Recovery

products. License revenue increased $43 million primarily due to an increase in sales of our NetBackup

appliances, partially offset by unfavorable foreign currency fluctuations.

Gross margin was 82% for fiscal 2015 compared to 83% for fiscal 2014 driven by growth in our lower

margin appliance business.

Operating income declined $34 million year over year as lower operating expenses largely offset lower net

revenue. Our operating expenses decreased $138 million year over year due to our cost savings initiatives and

favorable foreign currency effects of $66 million. Fiscal 2015 operating expenses included $252 million of

restructuring, separation, and transition costs compared to $264 million in fiscal 2014. We expect our operating

margins to fluctuate in future periods as a result of a number of factors, including our operating results and the

timing and amount of expenses incurred.

Net cash provided by operating activities was $1.3 billion for fiscal 2015, which resulted from net income of

$878 million adjusted for non-cash items, including depreciation and amortization charges of $443 million and

stock-based compensation expense of $195 million. These amounts were partially offset by decreases in deferred

income taxes of $23 million and income taxes payable of $191 million.

Deferred revenue decreased $239 million year over year primarily due to unfavorable foreign currency

fluctuations.

34