Symantec 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the levels of market interest rates, with all other variables held constant. On April 3, 2015 and March 28, 2014, a

hypothetical 50 bps increase or decrease in market interest rates would change the fair value of the fixed-rate

senior notes by a decrease of approximately $39 million and $48 million, respectively and an increase of

approximately $40 million and $49 million, respectively. However, this hypothetical change in market interest

rates would not impact the interest expense on the fixed-rate debt.

Foreign currency exchange rate risk

We conduct business in 43 currencies through our worldwide operations and, as such, we are exposed to

foreign currency risk. Foreign currency risks are associated with our cash and cash equivalents, investments,

receivables, and payables denominated in foreign currencies. Our exposure to foreign currency transaction gains

and losses is the result of certain net receivables due from our foreign subsidiaries and customers being

denominated in currencies other than the functional currency of the subsidiary, primarily the Euro and Singapore

dollar. Our foreign subsidiaries conduct their businesses in local currency. We have entered into foreign

exchange forward contracts with up to six months in duration, to offset the foreign exchange risk on certain

monetary assets and liabilities denominated in currencies other than the functional currency of the subsidiary. We

considered the historical trends in currency exchange rates and determined that it was reasonably possible that

adverse changes in exchange rates for all currencies could be experienced. The estimated impacts of a ten percent

appreciation or depreciation of foreign currency are as follows:

April 3, 2015 March 28, 2014

Change in Fair Value Due to

10%

Change in Fair Value Due to

10%

Foreign Exchange

Forward Contract

Notional

Amount Appreciation Depreciation

Notional

Amount Appreciation Depreciation

(Dollars in millions)

Purchased $ 102 $ 10 $ (10) $ 154 $ 15 $ (15)

Sold (195) (19) 19 (240) (24) 24

Total net outstanding contracts $ (93) $ (9) $ 9 $ (86) $ (9) $ 9

We do not use derivative financial instruments for speculative trading purposes, nor do we hedge our

foreign currency exposure in a manner that entirely offsets the effects of the changes in foreign exchange rates.

Item 8. Financial Statements and Supplementary Data

Annual financial statements

The Consolidated Financial Statements and related disclosures included in Part IV, Item 15 of this annual

report are incorporated by reference into this Item 8.

Selected quarterly financial data

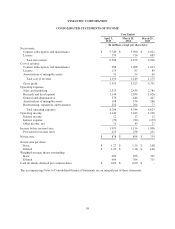

Fiscal 2015 Fiscal 2014

Apr. 3,

2015

Jan. 2,

2015

Oct. 3,

2014

Jul. 4,

2014

Mar. 28,

2014

Dec. 27,

2013

Sep. 27,

2013

Jun. 28,

2013

(In millions, except per share data)

Net revenue $ 1,518 $ 1,638 $ 1,617 $ 1,735 $ 1,625 $ 1,705 $ 1,637 $ 1,709

Gross profit 1,231 1,359 1,339 1,426 1,343 1,422 1,353 1,409

Operating income 152 327 348 322 306 405 248 224

Net income 176 222 244 236 217 283 241 157

Net income per share —

basic 0.26 0.32 0.35 0.34 0.31 0.41 0.34 0.23

Net income per share —

diluted 0.25 0.32 0.35 0.34 0.31 0.40 0.34 0.22

51