Symantec 2015 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2015 Symantec annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

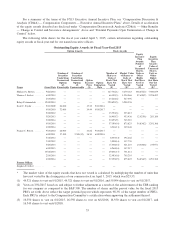

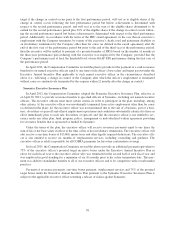

The table below sets forth the grant date fair value determined in accordance with FASC Topic 718 princi-

ples established in fiscal years 2013-2015 for the performance-related component of these awards (i) based

upon the probable outcome of the fiscal years 2013-2015 performance-related component as of the grant

date, and (ii) based upon achieving the maximum level of performance under the fiscal years 2013-2015

performance-related component as of the grant date. Also set forth below are the grant date fair values per-

taining to the market-related component or the TSR adjustment and significant inputs and assumptions used

in the Monte Carlo model, determined upon grant in fiscal years 2013-2015, and which is not subject to

probable or maximum outcome assumptions.

Name

Fiscal

Year

Probable Outcome of

Performance

Conditions Grant

Date Fair Value

($)

Maximum

Outcome of

Performance

Conditions Grant

Date Fair Value

($)

Market-Related

Component Grant

Date Fair Value

($)

Michael A. Brown .................... 2015 9,017,952 14,110,442 10,609,355

Thomas J. Seifert ..................... 2015 2,540,404 3,312,488 2,490,592

Balaji Yelamanchili ................... 2015 — — —

Scott C. Taylor ....................... 2015 1,427,183 1,860,935 1,399,199

2014 606,769 849,476 638,704

2013 538,670 607,145 456,500

Francis C. Rosch ..................... 2015 1,427,183 1,860,935 1,399,199

Stephen E. Gillett ..................... 2015 2,497,577 3,256,645 2,448,605

2014 1,820,331 2,548,464 1,916,138

Grant Date

Grant Date

Fair Value ($) Volatility (%)

Risk-Free

Interest Rate (%)

5/10/2012 .................................. 16.60 32.21 0.36

5/20/2013 .................................. 26.03 28.80 0.38

6/10/2014 .................................. 25.08 26.20 0.84

9/24/2014 .................................. 30.78 22.89 0.84

(4) Represents the executive officer’s annual bonus under the Executive Annual Incentive Plan for fiscal 2015,

which was earned in fiscal 2015 and paid in fiscal 2016.

(5) Represents (a) $10,000 for reimbursement for tax services, and (b) $12,000 for the Company’s con-

tributions to Mr. Brown’s account under its 401(k) plan.

(6) Mr. Brown received a prorated salary of $36,364 based on his period of employment as our interim Presi-

dent and Chief Executive Officer in fiscal 2014.

(7) Represents the following non-employee director compensation paid to Mr. Brown prior to his becoming our

interim President and Chief Executive Officer in March 2014:

Fees Earned

or Paid in Cash

($)*

Stock

Awards

($)†

Total

($)

105,023†† 234,978 340,000

* Mr. Brown received the following annual fees: (i) $50,000 annual retainer fee; (ii) $15,000 for serving

on the Compensation Committee; (ii) $15,000 for serving on the Nominating and Governance

Committee; and (iii) $25,000 for chairing the Compensation Committee.

†Amounts shown in this column reflect the aggregate full grant date fair value calculated in accordance

with FASC Topic 718 for awards granted during the fiscal year.

†† Includes cash payout of $22.50 for fractional share from non-employee director stock award grant.

(8) Represents (a) $154,730 in relocation expenses occurred in fiscal 2015, (b) $7,925 for reimbursement for tax

services, and (c) $11,400 for the Company’s contributions to Mr. Seifert’s account under its 401(k) plan.

(9) Mr. Seifert received a prorated salary of $30,000 based on his period of employment as our Executive Vice

President and Chief Financial Officer in fiscal 2014. His annual base salary is $720,000.

51