Starwood 2008 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Item 5. Market for Registrants’ Common Equity, Related Stockholder Matters and Issuer Purchases of

Equity Securities.

Market Information

The Corporation Shares are traded on the New York Stock Exchange (the “NYSE”) under the symbol “HOT.”

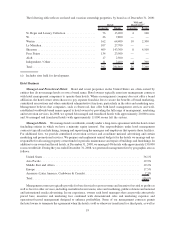

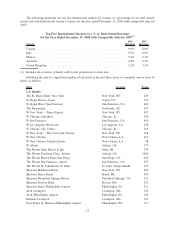

The following table sets forth, for the fiscal periods indicated, the high and low sale prices per Corporation

Share on the NYSE Composite Tape.

High Low

2008

Fourth quarter .................................................. $28.55 $10.97

Third quarter ................................................... $43.29 $25.95

Second quarter .................................................. $55.06 $38.89

First quarter .................................................... $56.00 $37.07

2007

Fourth quarter .................................................. $62.83 $42.78

Third quarter ................................................... $75.45 $52.63

Second quarter .................................................. $74.35 $65.35

First quarter .................................................... $69.65 $59.63

Holders

As of February 20, 2009, there were approximately 17,000 holders of record of Corporation Shares.

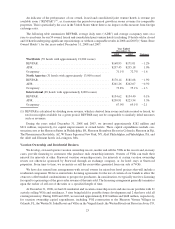

Dividends Made/Declared

The following table sets forth the frequency and amount of dividends made by the Corporation to holders of

Corporation Shares for the years ended December 31, 2008 and 2007:

Dividends

Declared

2008

Annual dividend ....................................................... $0.90

(a)

2007

Annual dividend ....................................................... $0.90

(b)

(a) The Corporation declared a dividend in the fourth quarter of 2008 to shareholders of record on December 31,

2008, which was paid in January 2009.

(b) The Corporation declared a dividend in the fourth quarter of 2007 to shareholders of record on December 31,

2007, which was paid in January 2008.

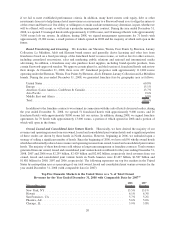

Conversion of Securities; Sale of Unregistered Securities

In 2006, we completed the redemption of the remaining 25,000 outstanding shares of Class B Exchangeable

Preferred Shares of the Trust (“Class B EPS”) for approximately $1 million in cash. Also in 2006, in connection

with the Host Transaction, we redeemed all of the Class A Exchangeable Preferred Shares of the Trust (“Class A

EPS”) (approximately 562,000 shares) and Realty Partnership units (approximately 40,000 units) for approximately

$34 million in cash. SLC Operating Limited Partnership units are convertible into Corporation Shares at the unit

holder’s option, provided that we have the option to settle conversion requests in cash or Corporation Shares. In

2006, we redeemed approximately 926,000 SLC Operating Limited Partnership units for approximately $56 million

25