Starwood 2008 Annual Report Download - page 131

Download and view the complete annual report

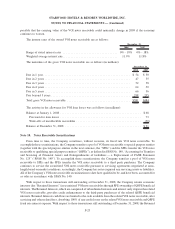

Please find page 131 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and enhances disclosures about fair value measurements. Fair value is defined under SFAS No. 157 as the exchange

price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most

advantageous market for the asset or liability in an orderly transaction between market participants on the

measurement date. Valuation techniques used to measure fair value under SFAS No. 157 must maximize the use of

observable inputs and minimize the use of unobservable inputs. The standard describes a fair value hierarchy based

on three levels of inputs, of which the first two are considered observable and the last unobservable, that may be

used to measure fair value as follows:

• Level 1 — Quoted prices in active markets for identical assets or liabilities.

• Level 2 — Inputs other than Level 1 that are observable, either directly or indirectly, such as quoted prices

for similar assets or liabilities; quoted prices in markets that are not active; or other inputs that are observable

or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

• Level 3 — Unobservable inputs that are supported by little or no market activity and that are significant to

the fair value of the assets or liabilities.

The adoption of this statement did not have a material impact on the Company’s consolidated financial

statements. See Note 11 for additional information.

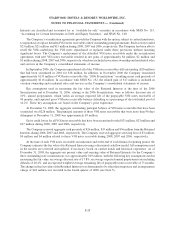

In December 2007, the Emerging Issues Task Force of the FASB (“EITF”) reached a consensus on EITF issue

No. 07-6 “Accounting for the Sale of Real Estate Subject to the Requirements of FASB Statement No. 66 When the

Agreement Includes a Buy-Sell Clause” (“EITF 07-6”). EITF 07-6 establishes that a buy-sell clause, in and of itself

does not constitute a prohibited form of continuing involvement that would preclude partial sales treatment under

FASB Statement No. 66. EITF 07-6 will be effective for new arrangements entered into in fiscal years beginning

after December 15, 2007 and interim periods within those fiscal years. The Company adopted EITF 07-6 on

January 1, 2008 and it did not have a material impact on the consolidated financial statements.

In June 2007, the FASB ratified the consensus reached by the EITF on Issue No. 06-11 “Accounting for Income

Tax Benefits of Dividends on Share-Based Payment Awards” (“EITF 06-11”). Under this consensus, a realized

income tax benefit from dividends or dividend equivalents that are charged to retained earnings and are paid to

employees under certain equity-based benefit plans should be recognized as an increase in additional paid-in

capital. The consensus is effective in fiscal years beginning after December 15, 2007 and should be applied

prospectively for income tax benefits derived from dividends declared after adoption. The Company adopted

EITF 06-11 on January 1, 2008 and it did not have an impact on the Company’s consolidated financial statements.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial

Liabilities Including an Amendment of FASB Statement No. 115” (“SFAS No. 159”) This standard permits entities

to choose to measure financial instruments and certain other items at fair value and is effective for the first fiscal

year beginning after November 15, 2007. SFAS No. 159 must be applied prospectively, and the effect of the first re-

measurement to fair value, if any, should be reported as a cumulative — effect adjustment to the opening balance of

retained earnings. The adoption of SFAS No. 159 is not expected to have a material impact on the Company’s

consolidated financial statements. The Company adopted SFAS No. 159 on January 1, 2008, and did not elect the

fair value option for any of its assets or liabilities.

In November 2006, the FASB ratified the consensus reached by the EITF on Issue No. 06-8, “Applicability of

the Assessment of a Buyer’s Continuing Investment under FASB Statement No. 66, Accounting for Sales of Real

Estate, for Sales of Condominiums” (“EITF 06-8”). EITF 06-8 will require condominium sales to meet the

continuing involvement criterion of SFAS No. 66 in order for profit to be recognized under the percentage of

completion method. EITF 06-8 will be effective for annual reporting periods beginning after March 15, 2007. The

cumulative effect of applying EITF 06-8, if any, is to be reported as an adjustment to the opening balance of retained

earnings in the year of adoption. The adoption of EITF 06-8 did not have a significant impact on the Company’s

financial statements or require a cumulative effect adjustment.

F-15

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)