Starwood 2008 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

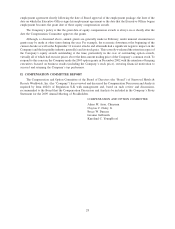

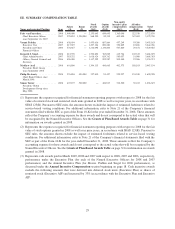

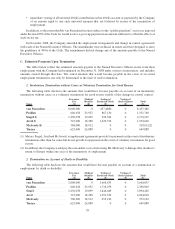

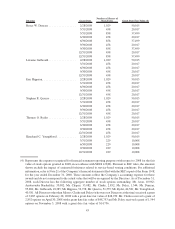

VIII. NONQUALIFIED DEFERRED COMPENSATION

The Company’s Deferred Compensation Plan (the “Plan”) permits eligible executives, including our Named

Executive Officers, to defer up to 100% of their Executive Plan or Executive AIP bonus, as applicable, and up to

75% of their base salary for a calendar year. The Company does not contribute to the Plan. Mr. van Paasschen made

deferrals under the Plan in 2008 but no other Named Executive Officer did.

Name

Executive

Contributions in

Last FY

($)

Registrant

Contributions

in Last FY

($)

Aggregate

Earnings

in Last FY

($)

Aggregate

Withdrawals/

Distributions

($)

Aggregate

Balance at

Last FYE

($)

van Paasschen .......... 500,000 — (128,686) — 371,314

Prabhu ................ — — — — —

Siegel ................. — — — — —

Avril .................. — — — — —

McAveety .............. — — — — —

Turner ................ — — — — —

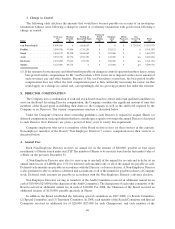

Deferral elections are made in December for base salary paid in pay periods beginning in the following

calendar year. Deferral elections are made in June for annual incentive awards that are earned for performance in

that calendar year but paid in March of the following year. Deferral elections are irrevocable.

Elections as to the time and form of payment are made at the same time as the corresponding deferral election.

A participant may elect to receive payment on February 1 of a calendar year while still employed or either 6 or

12 months following employment termination. Payment will be made immediately in the event a participant

terminates employment on account of death, disability or on account of certain changes in control. A participant

may elect to receive payment of his account balance in either a lump sum or in annual installments, so long as the

account balance exceeds $50,000; otherwise payment will be made in a lump sum.

If a participant elects an in-service distribution, the participant may change the scheduled distribution date or

form of payment so long as the change is made at least 12 months in advance of the scheduled distribution date. Any

such change must provide that distribution will commence at least five years later than the scheduled distribution

date. If a participant elects to receive distribution upon employment termination, that election and the corre-

sponding form of payment election are irrevocable. Withdrawals for hardship that results from an unforeseeable

emergency are available, but no other unscheduled withdrawals are permitted.

35