Starwood 2008 Annual Report Download - page 130

Download and view the complete annual report

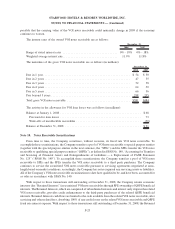

Please find page 130 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Retained Interests. The Company periodically sells notes receivable originated by its vacation ownership

business in connection with the sale of VOIs. The Company retains interests in the assets transferred to qualified and

non-qualified special purpose entities which are accounted for as over-collateralizations and interest only strips.

These retained interests are treated as “available-for-sale” transactions under the provisions of SFAS No. 115,

“Accounting for Certain Investments in Debt and Equity Securities.” The Company reports changes in the fair

values of these Retained Interests considered temporary through the accompanying consolidated statement of

comprehensive income. A change in fair value determined to be other-than-temporary is recorded as a loss in the

Company’s consolidated statement of income. The Company had Retained Interests of $19 million and $40 million

at December 31, 2008 and 2007, respectively.

Use of Estimates. The preparation of financial statements in conformity with accounting principles gen-

erally accepted in the United States requires management to make estimates and assumptions that affect the

reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the

financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results

could differ from those estimates.

Reclassifications. Certain reclassifications have been made to the prior years’ financial statements to

conform to the current year presentation.

Impact of Recently Issued Accounting Standards.

Adopted Accounting Standards

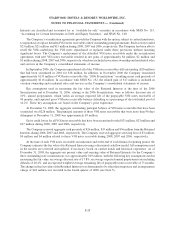

In January 2009, the FASB issued Financial Statement of Position (“FSP”) Issue No. EITF 99-20-1,

“Amendments to the Impairment Guidance of EITF Issue No. 99-20” (“FSP EITF No. 99-20-1”). FSP EITF

No. 99-20-1 amends the impairment guidance in EITF Issue No. 99-20, “Recognition of Interest Income and

Impairment on Purchased Beneficial Interests and Beneficial Interests that Continue to be Held by a Transferor in

Securitized Financial Assets” to achieve more consistent determination of whether an other-than-temporary

impairment has occurred. The Company adopted FSP EITF No. 99-20-1 in December 2008 and it did not have

a material impact on the consolidated financial statements.

In December 2008, the FASB issued FSP No. 140-4 and FIN No. 46(R)-8, “Disclosures by Public Entities

(Enterprises) about Transfers of Financial Assets and Interests in Variable Interest Entities” (“FSP No. 140-4”)

which amends FASB No. 140 “Accounting for Transfers and Servicing of Financial Assets and Extinguishment of

Liabilities, a replacement of SFAS No. 125” and FIN No. 46 (R) “Consolidation of Variable Interest Entities” to

require public enterprises, including sponsors that have a variable interest in a variable interest entity, to provide

additional disclosures about their involvement with variable interest entities. This FSP No. 140-4 is effective in

reporting periods ending after December 15, 2008. The Company adopted FSP No. 140-4 in December 2008 and it

did not have a material impact on its consolidated financial statements.

In May 2008, the FASB issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles”

(“SFAS 162”). SFAS No. 162 identifies the sources of accounting principles and the framework for selecting the

principles to be used in the preparation of financial statements of nongovernmental entities that are presented in

conformity with GAAP. Effective November 15, 2008, the Company adopted SFAS No. 162, which did not have

any impact on the Company’s financial statements.

Effective January 1, 2008, the Company adopted Statement of Financial Accounting Standards (“SFAS”)

No. 157, “Fair Value Measurements” (“SFAS No. 157”). In February 2008, the Financial Accounting Standards

Board (“FASB”) issued FSP No. SFAS 157-2, “Effective Date of FASB Statement No. 157,” which provides a one

year deferral of the effective date of SFAS No. 157 for non-financial assets and non-financial liabilities, except those

that are recognized or disclosed in the financial statements at fair value at least annually. Therefore, the Company

has adopted the provisions of SFAS No. 157 with respect to its financial assets and liabilities only. SFAS No. 157

defines fair value, establishes a framework for measuring fair value under generally accepted accounting principles

F-14

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)