Starwood 2008 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Interests are classified and accounted for as “available-for-sale” securities in accordance with SFAS No. 115,

“Accounting for Certain Investments in Debt and Equity Securities,” and SFAS No. 140.

The Company’s securitization agreements provide the Company with the option, subject to certain limitations,

to repurchase or replace defaulted VOI notes receivable at their outstanding principal amounts. Such activity totaled

$23 million, $21 million and $15 million during 2008, 2007 and 2006, respectively. The Company has been able to

resell the VOIs underlying the VOI notes repurchased or replaced under these provisions without incurring

significant losses. The Company’s replacement of the defaulted VOI notes receivable under the securitization

agreements with new VOI notes receivable resulted in net gains of approximately $4 million, $2 million and

$1 million during 2008, 2007 and 2006, respectively, which are included in vacation ownership and residential sales

and services in the Company’s consolidated statements of income.

In September 2006, the Company repurchased all of the VOI notes receivables still outstanding ($20 million)

that had been securitized in 2001 for $18 million. In addition, in November 2006 the Company securitized

approximately $133 million of VOI notes receivable (the “2006 Securitization”) resulting in net cash proceeds of

approximately $116 million. In accordance with SFAS No. 152, the related gain of $17 million is included in

vacation ownership and residential sales and services in the Company’s consolidated statements of income.

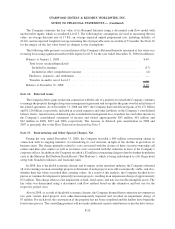

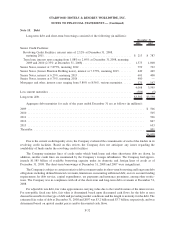

Key assumptions used in measuring the fair value of the Retained Interests at the time of the 2006

Securitization and at December 31, 2006, relating to the 2006 Securitization, were as follows: discount rate of

10%; annual prepayments, which yields an average expected life of the prepayable VOI notes receivable of

94 months; and expected gross VOI notes receivable balance defaulting as a percentage of the total initial pool of

14.2%. These key assumptions are based on the Company’s prior experience.

At December 31, 2008, the aggregate outstanding principal balance of VOI notes receivable that have been

securitized was $228 million. The principal amounts of those VOI notes receivables that were more than 90 days

delinquent at December 31, 2008 was approximately $5 million.

Gross credit losses for all VOI notes receivable that have been securitized totaled $31 million, $23 million and

$17 million during 2008, 2007 and 2006, respectively.

The Company received aggregate cash proceeds of $26 million, $33 million and $36 million from the Retained

Interests during 2008, 2007 and 2006, respectively. The Company received aggregate servicing fees of $3 million,

$4 million and $4 million related to these VOI notes receivable during 2008, 2007 and 2006, respectively.

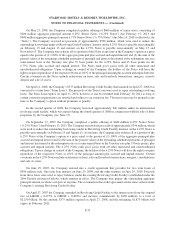

At the time of each VOI notes receivable securitization and at the end of each financial reporting period, the

Company estimates the fair value of its Retained Interests using a discounted cash flow model. All assumptions used

in the models are reviewed and updated, if necessary, based on current trends and historical experience. As of

December 31, 2008, the aggregate net present value and carrying value of Retained Interests for the Company’s

three outstanding note securitizations was approximately $19 million, with the following key assumptions used in

measuring the fair value: an average discount rate of 17.8%, an average expected annual prepayment rate including

defaults of 20.4%, and an expected weighted average remaining life of prepayable notes receivable of 73 months.

The change in the fair value of the Retained Interests was determined to be other than temporary and an impairment

charge of $22 million was recorded in the fourth quarter of 2008 (see Note 5).

F-24

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)