Starwood 2008 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

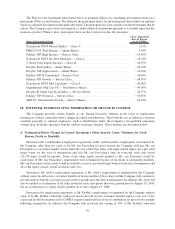

Transition Committee received an additional fee of $10,000. The members of these special committees were able to

elect to receive such fees in cash or stock. For Directors electing stock, the number of shares awarded was

determined by dividing the amount by the Fair Market Value (as defined in the LTIP) on the date of grant. These

special committee shares generally vest upon the earlier of (i) the third anniversary of the grant date and (ii) the date

such person ceases to be a Director of the Company.

B. Attendance Fees

Non-Employee Directors do not receive fees for attendance at meetings. However, the Company reimburses

Non-Employee Directors for expenses they incurred related to 2008 meeting attendance, including attendance by

spouses at one meeting each year.

C. Equity grant

In 2008, each Non-Employee Director received an annual equity grant (made at the same time as the annual

grant is made to other employees) under our LTIP with a value of $100,000. The equity grant was delivered 50% in

stock units and 50% in stock options. The number of stock units is determined by dividing the value ($50,000) by the

average of the high and low price on the date of grant. The number of options is determined by dividing the value

($50,000) by the average of the high and low price on the date of grant (also the exercise price) and multiplying by

three. For the 2009 grant, the ratio was lowered to 2.5-to-1. The options are fully vested and exercisable upon grant

and are scheduled to expire eight years after the grant date. The restricted stock awarded pursuant to the annual grant

generally vests upon the earlier of (i) the third anniversary of the grant date and (ii) the date such person ceases to be

a Director of the Company.

D. Starwood Preferred Guest Program Points and Rooms

In 2008, each Non-Employee Director other than Mr. Daley received an annual grant of 750,000 Starwood

Preferred Guest (“SPG”) Points to encourage them to visit and personally evaluate our properties. Mr. Daley

received a grant of 375,000 SPG Points in light of his November 2008 election to the Board.

E. Other Compensation

In 2008, the Company made available to the Chairman of the Board administrative assistant services and health

insurance coverage on terms comparable to those available to Starwood executives until the Chairman turns

70 years old and thereafter on terms available to Company retirees (including required contributions). The

Company also reimburses Non-Employee Directors for travel expenses, other out-of-pocket costs they incur when

attending meetings and, for one meeting per year, expenses related to attendance by spouses.

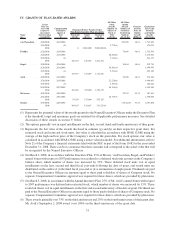

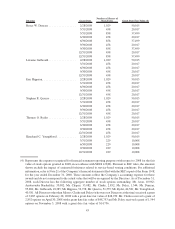

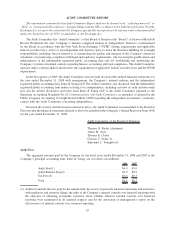

We have summarized the compensation paid by the Company to our Non-Employee Directors in 2008 in the

table below.

Name of Director

Fees earned

or Paid in Cash

($) (1)

Stock

Awards (2)(3)

($)

Option

Awards (4)

($)

All Other

compensation (5)

($)

Total

($)

Adam M. Aron ............ 20,000 94,077 48,939 11,250 174,266

Charlene Barshefsky ........ 20,000 94,077 48,939 15,431 178,447

Jean-Marc Chapus ......... 25,000 40,713 48,939 11,250 125,902

Thomas E. Clarke .......... 37,500 41,218 48,753 11,250 138,721

Clayton C. Daley, Jr. ........ 6,196 6,762 14,756 N/A 27,714

Bruce W. Duncan .......... 35,000 222,499 48,939 102,246 408,684

Lizanne Galbreath .......... 15,000 94,077 48,939 15,595 173,611

Eric Hippeau .............. 40,000 94,077 48,939 30,986 214,002

Stephen R. Quazzo ......... 55,000 94,077 48,939 11,250 209,266

Thomas O. Ryder .......... 55,000 94,077 48,939 24,699 222,715

Kneeland C. Youngblood . . . . . 50,000 54,043 48,939 18,750 171,732

41