Starwood 2008 Annual Report Download - page 156

Download and view the complete annual report

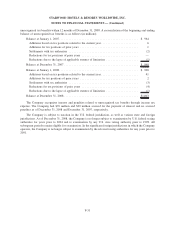

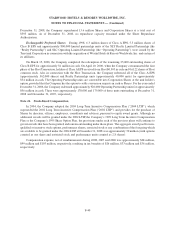

Please find page 156 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.December 31, 2008, the Company repurchased 13.6 million Shares and Corporation Shares at a total cost of

$593 million. As of December 31, 2008, no repurchase capacity remained under the Share Repurchase

Authorization.

Exchangeable Preferred Shares. During 1998, 6.3 million shares of Class A EPS, 5.5 million shares of

Class B EPS and approximately 800,000 limited partnership units of the SLT Realty Limited Partnership (the

“Realty Partnership”) and SLC Operating Limited Partnership (the “Operating Partnership”) were issued by the

Trust and Corporation in connection with the acquisition of Westin Hotels & Resorts Worldwide, Inc. and certain of

its affiliates.

On March 15, 2006, the Company completed the redemption of the remaining 25,000 outstanding shares of

Class B EPS for approximately $1 million in cash. On April 10, 2006, when the Company consummated the first

phase of the Host Transaction, holders of Class A EPS received from Host $0.503 in cash and 0.6122 shares of Host

common stock. Also in connection with the Host Transaction, the Company redeemed all of the Class A EPS

(approximately 562,000 shares) and Realty Partnership units (approximately 40,000 units) for approximately

$34 million in cash. The Operating Partnership units are convertible into Corporation Shares at the unit holder’s

option, provided that the Company has the option to settle conversion requests in cash or Shares. For the year ended

December 31, 2006, the Company redeemed approximately 926,000 Operating Partnership units for approximately

$56 million in cash. There were approximately 178,000 and 179,000 of these units outstanding at December 31,

2008 and December 31, 2007, respectively.

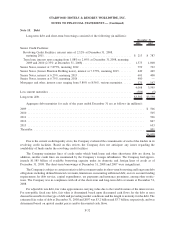

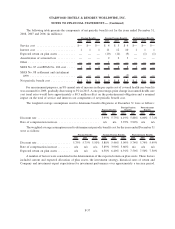

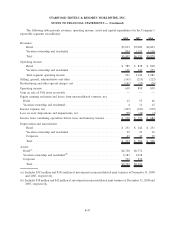

Note 21. Stock-Based Compensation

In 2004, the Company adopted the 2004 Long-Term Incentive Compensation Plan (“2004 LTIP”), which

superseded the 2002 Long Term Incentive Compensation Plan (“2002 LTIP”) and provides for the purchase of

Shares by directors, officers, employees, consultants and advisors, pursuant to equity award grants. Although no

additional awards will be granted under the 2002 LTIP, the Company’s 1999 Long Term Incentive Compensation

Plan or the Company’s 1995 Share Option Plan, the provisions under each of the previous plans will continue to

govern awards that have been granted and remain outstanding under those plans. The aggregate award pool for non-

qualified or incentive stock options, performance shares, restricted stock or any combination of the foregoing which

are available to be granted under the 2004 LTIP at December 31, 2008 was approximately 70 million (with options

counted as one share and restricted stock and performance units counted as 2.8 shares).

Compensation expense, net of reimbursements during 2008, 2007 and 2006 was approximately $68 million,

$99 million and $103 million, respectively, resulting in tax benefits of $26 million, $33 million and $36 million,

respectively.

F-40

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)