Starwood 2008 Annual Report Download - page 136

Download and view the complete annual report

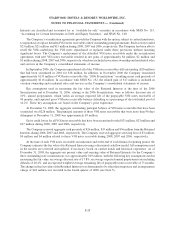

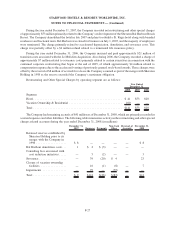

Please find page 136 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.remaining balance reducing additional paid in capital. This portion of the transaction was treated as a non-cash

exchange by Starwood and, consequently, was excluded from the consolidated statement of cash flows. The portion

of the transaction between the Company and Host was recorded as a disposition under the provisions of

SFAS No. 144. As Starwood sold these hotels subject to long-term management contracts, the calculated gain

on the sale of approximately $962 million has been deferred and is being amortized over the initial management

contract term of 20 years. This transaction also generated a capital loss, net of carry back and 2006 utilization, of

$2.4 billion for federal tax purposes. The entire tax benefit of the loss was offset by a valuation allowance due to the

uncertainty of realizing the tax benefit of this capital loss carryforward before its expiration in 2011. See Note 14.

The Company sold all of the Host common stock in the second quarter of 2006 and recorded a net gain of

approximately $1 million.

During 2006, the Company sold ten additional hotels in multiple transactions for approximately $437 million

in cash. The Company recorded a net loss of approximately $7 million associated with these sales. In addition, the

Company recorded a $5 million adjustment to reduce the gain on the sale of a hotel consummated in 2004 as certain

contingencies associated with that sale became probable in 2006.

Also in 2006, the Company recorded a loss of approximately $23 million primarily in connection with the

impairment of two properties, one of which has been demolished and is being rebuilt under the Aloft and Element

brands and another which represents land that was sold to a developer who is building two Starwood branded hotels

on the site. This loss was offset by a gain of approximately $29 million on the sale of the Company’s interests in two

joint ventures.

Also during 2006, the Company recorded an impairment charge of $11 million related to the Sheraton Cancun

in Cancun, Mexico that was damaged by Hurricane Wilma in 2005 and was completely demolished in order to build

additional vacation ownership units. This impairment charge was offset by a $13 million gain as a result of

insurance proceeds received primarily for the Sheraton Cancun and the Company’s other owned hotel in Cancun,

the Westin Cancun, as reimbursement for property damage caused by the same storm.

In September 2006, a joint venture, in which the Company has a minority interest, completed the sale of the

Westin Kierland hotel in Scottsdale, Arizona and the Company realized net proceeds of approximately $45 million.

The Company continues to manage the hotel subject to a newly amended, long-term management contract.

Accordingly, the Company’s share of the gain on the sale of approximately $46 million was deferred and is being

recognized in earnings over the remaining 21 years of the management contract.

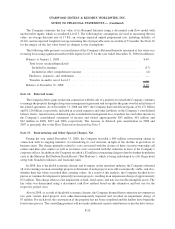

Note 6. Assets Held for Sale

During the first quarter of 2008, the Company entered into a purchase and sale agreement for the sale of a hotel

for total consideration of $10 million. The Company received a non-refundable deposit from the prospective buyer

during the first quarter of 2008. The Company recorded an impairment charge of approximately $1 million in the

first quarter of 2008 related to this hotel. The sale of this hotel is expected to be completed in 2009.

F-20

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)