Starwood 2008 Annual Report Download - page 35

Download and view the complete annual report

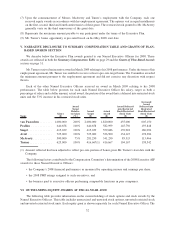

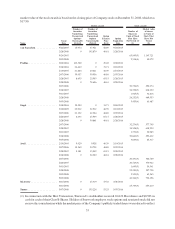

Please find page 35 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.returns achieved by stockholders, providing a direct link between the interests of stockholders and the Named

Executive Officers. Long-term incentive compensation for our Named Executive Officers consists primarily of

equity compensation awards granted annually under the Company’s LTIP and secondarily of the portion of the

Executive Plan and Executive AIP awards that are deferred in the form of deferred stock units and shares of

restricted stock, respectively. Taken together, approximately 60-65% of total compensation at target is equity-

based long term incentive compensation.

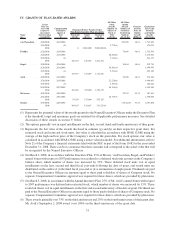

The Compensation Committee generally grants awards under the LTIP annually to all other Named Executive

Officers that are a combination of stock options and restricted stock awards. In 2008 we used a grant approach in

which the award is articulated as a dollar value. Under this approach, an overall award value, in dollars, was

determined for each executive based upon our compensation strategy and competitive market positioning. We

generally targeted the value of these awards so that total compensation at target is set at the 65th percentile of our

peer group, though individual awards may have been higher or lower based on individual performance (determined

as described in the Executive AIP assessment above). The number of restricted stock shares is calculated by

dividing 75% of the award value by the fair market value of the Company’s stock on the grant date. The number of

stock options has generally been determined by dividing the remaining 25% of the award value by the fair market

value of the Company’s stock on the grant date and multiplying the result by three. In light of the stock price and

leverage opportunity, the Compensation Committee reduced this ratio to 2.5 for equity awards made in 2009. The

Named Executive Officers are able to elect a greater portion of options (up to 100% options).

The exercise price for each stock option is equal to fair market value of the Company’s common stock on

the option grant date. See the section entitled Equity Grant Practices on page 27 below for a description of

the manner in which we determine fair market value for this purpose. Currently, most stock options vest in 25%

increments annually starting with the first anniversary from the date of grant. For stock options granted in

2008, awards granted to associates who are retirement eligible, as defined in the LTIP, vest in 16 equal

quarterly periods. Unexercised, stock options expire 8 years from the date of grant, or earlier in the event of

termination of employment. Stock options provide compensation only when vested and only if the Company’s

stock price appreciates and exceeds the exercise price of the option. Therefore, during business downturns,

option awards may not represent any economic value to an executive.

Restricted stock units and restricted stock provide some measure of mitigation of business cyclicality

while maintaining a direct tie to share price. The Company seeks to enhance the link to stockholder

performance by building a strong retention incentive into the equity program. Consequently, for 2008 grants,

75% of restricted stock units and awards vest on the third anniversary of the date of grant and the remaining

25% vests on the fourth anniversary of the date of grant. For restricted stock granted in 2008, awards granted to

associates who are retirement eligible, as defined in the LTIP, vest in sixteen equal quarterly periods. This

delayed vesting places an executive’s long-term compensation at risk to share price performance for a

significant portion of the business cycle, while encouraging long-term retention of executives.

As mentioned above, Named Executive Officers have a mandatory deferral of 25% of their awards under

the Executive Plan in the form of deferred stock units, unless reduced in the discretion of the Compensation

Committee. As such, the awards combine performance-based compensation with a further link to stockholder

interests. First, amounts must be earned based on annual Company financial and strategic/operational

performance under the Executive Plan. Second, these already earned amounts are put at risk through a

vesting schedule. Vesting occurs in installments for employment over a three-year period. Third, these earned

amounts become subject to share price performance. Primarily in consideration of this vesting risk being

applied to already earned compensation (but also taking into account the enhanced stockholder alignment that

results from being subject to share performance), the deferred amount is increased by 33% of value. The

Compensation Committee has the discretion to accelerate vesting or pay out deferred amounts in cash (without

interest and without the percentage increase in value) in a limited number of termination circumstances (e.g.,

involuntary terminations or retirements).

Mr. van Paasschen agreed not to sell any Company stock awards or shares received on exercise of options

(except as may be withheld for taxes) for the first two years of his employment and thereafter only in

consultation with the Board of Directors.

23