Starwood 2008 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

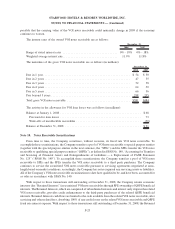

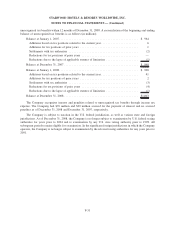

The Company estimates the fair value of its Retained Interests using a discounted cash flow model with

unobservable inputs, which is considered Level 3. The following key assumptions are used in measuring the fair

value: an average discount rate of 17.8%, an average expected annual prepayment rate, including defaults, of

20.4%, and an expected weighted-average remaining life of prepayable notes receivable of 73 months. See Note 10

for the impact on the fair value based on changes to the assumptions.

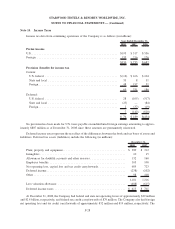

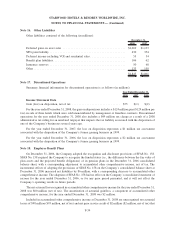

The following table presents a reconciliation of the Company’s Retained Interests measured at fair value on a

recurring basis using significant unobservable inputs (Level 3) for the year ended December 31, 2008 (in millions):

Balance at January 1, 2008 .................................................. $40

Total losses (realized/unrealized)

Included in earnings .................................................... (17)

Included in other comprehensive income..................................... (4)

Purchases, issuances, and settlements ......................................... —

Transfers in and/or out of Level 3 ........................................... —

Balance at December 31, 2008 ............................................... $19

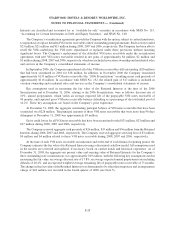

Note 12. Deferred Gains

The Company defers gains realized in connection with the sale of a property for which the Company continues

to manage the property through a long-term management agreement and recognizes the gains over the initial term of

the related agreement. As of December 31, 2008 and 2007, the Company had total deferred gains of $1.151 billion

and $1.216 billion, respectively, included in accrued expenses and other liabilities in the Company’s consolidated

balance sheets. Amortization of deferred gains is included in management fees, franchise fees and other income in

the Company’s consolidated statements of income and totaled approximately $83 million, $81 million and

$62 million in 2008, 2007 and 2006, respectively. The increase in deferred gain amortization in 2008 and

2007 is primarily due to the Host Transaction discussed in Note 5.

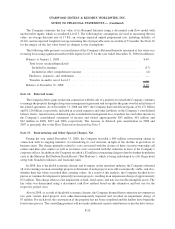

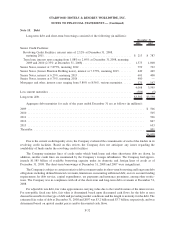

Note 13. Restructuring and Other Special Charges, Net

During the year ended December 31, 2008, the Company recorded a $60 million restructuring charge in

connection with its ongoing initiative of rationalizing its cost structure in light of the decline in growth in its

business units. The charge primarily related to costs associated with the closure of three vacation ownership call

centers and nine sales centers as well as severance costs associated with the reduction in force at the Company’s

corporate offices. In addition, the Company recorded a $2 million restructuring charge related to further demolition

costs at the Sheraton Bal Harbour Beach Resort (“Bal Harbour”), which is being redeveloped as a St. Regis hotel

along with branded residences and fractional units.

In 2008, due to the global economic climate and its impact on the timeshare industry, the Company evaluated

all of its existing vacation ownership projects to determine if such projects were still economically viable, and if so,

whether their fair values exceeded their carrying values. As a result of this analysis, the Company decided not to

pursue or continue development at primarily two main projects, resulting in an impairment charge of approximately

$72 million. This charge relates to the impairment of land, fixed assets, and non recoverable intangible assets. The

fair value was determined using a discounted cash flow method based on the alternative and best use for the

respective project sites.

Also in 2008, as a result of the global economic climate, the Company deemed that its minority investments in

two joint venture hotel projects were other-than-temporarily impaired and recorded an impairment charge of

$7 million. For each hotel, the construction of the property has not been completed and the lenders have begun the

foreclosure process. The controlling partners will not make additional capital contributions or pay the debt service.

F-26

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)