Starwood 2008 Annual Report Download - page 37

Download and view the complete annual report

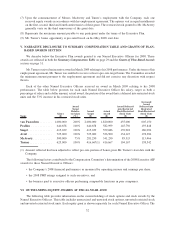

Please find page 37 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Potential Payments Upon Termination or Change of Control. The Change of Control Severance Agreements are

intended to promote stability and continuity of senior management. The Company believes that the provision of

severance pay to these Named Executive Officers upon a change of control aligns their interests with those of

stockholders. In addition, for executive officers hired in 2008, the Company changed its policy on providing tax

gross-ups in change in control agreements. As a result, the change in control arrangements with Messrs. Avril,

McAveety and Turner provide that the benefits are to be reduced until the executive is better off paying the excise

tax rather than reducing benefits. By making severance pay available, the Company is able to mitigate executive

concern over employment termination in the event of a change of control that benefits stockholders. In addition, the

acceleration of equity compensation vesting in connection with a change of control provides these Named

Executive Officers with protection against equity forfeiture due to termination and ample incentive to achieve

Company goals, including facilitating a sale of the Company at the highest possible price per share, which would

benefit both stockholders and executives. In addition, the Company acknowledges that seeking a new senior

position is a long and time consuming process. Lastly, each severance agreement permits the executive to maintain

certain benefits for a period of two years following termination and to receive outplacement services. The aggregate

effect of our change of control provisions is intended to focus executives on maximizing value to stockholders. In

addition, should a change of control occur, benefits will be paid after a “double trigger” event as described in

Potential Payments Upon Termination or Change in Control. Benefit levels have been set to be competitive with

peer group practices.

In connection with Section 409A of the Internal Revenue Code of 1986, as amended (“Section 409A), the

Company amended the employment arrangements with each of the Named Executive Officers (including the CEO).

These amendments made several technical changes designed to make the employment arrangements with such

officers comply with Section 409A and the final regulations issued thereunder, and generally affect the timing, but

not the amount of compensation of such officers under specified circumstances.

3. Additional Severance Arrangements

On August 14, 2007, the Company entered into a letter agreement with Mr. Siegel. The letter agreement

provided for the acceleration of 50% of Mr. Siegel’s then unvested restricted stock and options in the event his

employment was terminated without cause or by the executive for good reason within two years of the hiring of a

new Chief Executive Officer. The purpose of the letter agreement was to support retention, stability and continuity

and succession planning and to provide assurance to a key executive in a time of uncertainty regarding the

Company’s chief executive officer position. The special severance will expire on August 14, 2009.

In addition, the Company entered into a letter agreement with Mr. Prabhu clarifying that his severance

included the acceleration of 50% of unvested restricted stock and options in the event that his employment was

terminated without cause or by him for good reason. The clarification formally documented Mr. Prabhu’s existing

severance arrangements as part of his employment by the Company.

C. Background Information on the Executive Compensation Program

1. Use of Peer Data

In determining competitive compensation levels, the Compensation Committee reviews data from several

major compensation consulting firms that reflects compensation practices for executives in comparable positions in

a peer group consisting of companies in the hotel and hospitality industries and companies with similar revenues in

other industries relevant to key talent recruitment needs. The executive team and Compensation Committee review

the peer group bi-annually to ensure it represents a relevant market perspective. The Compensation Committee

utilizes the peer group for a broad set of comparative purposes, including levels of total compensation, pay mix,

incentive plan and equity usage and other terms of employment. The Compensation Committee also reviews

Company performance against the performance of companies in this peer group. The Company believes that by

conducting the competitive analysis using a broad peer group, which includes companies outside the hospitality

industry, it is able to attract and retain talented executives from outside the hospitality industry. The Company’s

experience has proven that key executives with diversified experience prove to be major contributors to its

continued growth and success.

25