Starwood 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Benefits and Perquisites. Base salary and incentive compensation are supplemented by benefits and

perquisites.

Current Benefits. The Company provides employee benefits that are consistent with local practices and

competitive markets, including group health benefits, life and disability insurance, medical and dependent care

flexible spending accounts and a pre-tax premium payment arrangement. Each of these benefits is provided to

a broad group of employees within the Company and our Named Executive Officers participate in the

arrangements on the same basis as other employees.

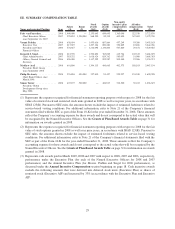

Perquisites. As reflected in the Summary Compensation Table below, the Company provides certain

limited perquisites to select Named Executive Officers when necessary to provide an appropriate compen-

sation package to those Named Executive Officers, particularly in connection with enabling the executives and

their families to smoothly transition from previous positions which may require relocation.

For example, Mr. van Paasschen’s employment agreement provides that the Company will provide Mr.

van Paasschen with up to a $500,000 credit (based on the Standard Industry Fare Level formula) for personal

use of the Company’s aircraft during the first 12 months of his employment with the Company, $495,086 of

which was used. Mr. van Paasschen and his immediate family had access to a Company owned or leased

airplane on an “as available” basis for personal travel, i.e., assuming such plane was not needed for business

purposes, with an obligation to reimburse for personal use based upon the Company’s operating cost, subject to

the credit described above.

The Company also reimburses Named Executive Officers generally for travel expenses and other out-of-

pocket costs incurred with respect to attendance by their spouses at one meeting of the Board each year.

Retirement Benefits. The Company maintains a tax-qualified retirement savings plan pursuant to Code

section 401(k) for a broadly-defined group of eligible employees that includes the Company’s Named

Executive Officers. Eligible employees may contribute a portion of their eligible compensation to the plan on a

before-tax basis, subject to certain limitations prescribed by the Code. Prior to 2008, the Company matched

100% of the first 2% of eligible compensation and 50% of the next 2% of eligible compensation that an eligible

employee contributes. Beginning in 2008, the Company matched 100% of the first 1% of eligible compen-

sation and 50% of the next 6% of eligible compensation that an eligible employee contributes. These matching

contributions, as adjusted for related investment returns, become fully vested upon the eligible employee’s

completion of three years of service with the Company. Our Named Executive Officers, in addition to certain

other eligible employees, were permitted to make additional deferrals of base pay and regular annual incentive

awards under our nonqualified deferred compensation plan. This plan is discussed in further detail under the

heading Nonqualified Deferred Compensation on page 35.

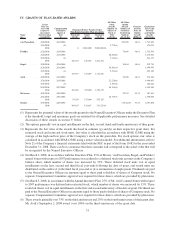

2. Change of Control Arrangements

Following the consummation of the sale of 33 hotels to Host Hotels & Resorts and the related return of capital

to stockholders, the Board reviewed the change of control arrangements then in place with the Named Executive

Officers and decided to enter into new change of control agreements with the Named Executive Officers at that time,

which included Messrs. Prabhu and Siegel. On March 25, 2005, the Company adopted a policy proscribing certain

terms of severance agreements triggered upon a change in control of the Company. Pursuant to the policy, the

Company is required to seek stockholder approval of severance agreements with executive officers that provide

Benefits (as defined in the policy) in excess of 2.99 times base salary plus such officer’s most recent bonus.

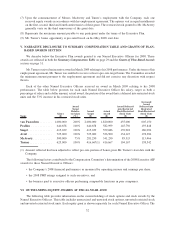

In connection with the hiring of Messrs. McAveety and Turner and the promotion of Mr. Avril, the Company

entered into change of control arrangements with them that were similar to the arrangements in place for the other

Named Executive Officers (other than the CEO). The arrangements with Messrs. McAveety, Turner and Avril,

however, do not provide for a tax gross up if the benefits payable thereunder are subject to the 280G excise tax.

Instead, the benefits provided are reduced until the point that the executive would be better off paying the excise tax

rather than reducing benefits.

The Company also included change of control arrangements in Mr. van Paasschen’s employment agreement.

These change of control arrangements are described in more detail beginning on page 36 under the heading entitled

24