Starwood 2008 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

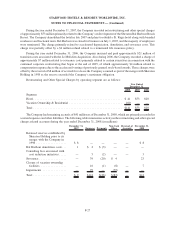

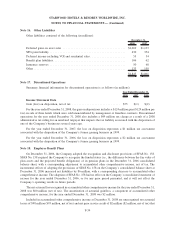

The Company completed a sensitivity analysis on the net present value of the Retained Interests to measure the

change in value associated with independent changes in individual key variables. The methodology applied

unfavorable changes for the key variables of expected prepayment rates, discount rates and expected gross credit

losses as of December 31, 2008. The decreases in value of the Retained Interests that would result from various

independent changes in key variables are shown in the chart that follows (in millions). The factors may not move

independently of each other.

Annual prepayment rate:

100 basis points-dollars .................................................. $ 0.4

100 basis points-percentage ............................................... 2.4%

200 basis points-dollars .................................................. $ 0.8

200 basis points-percentage ............................................... 4.6%

Discount rate:

100 basis points-dollars .................................................. $ 0.3

100 basis points-percentage ............................................... 1.9%

200 basis points-dollars .................................................. $ 0.7

200 basis points-percentage ............................................... 3.7%

Gross annual rate of credit losses:

100 basis points-dollars .................................................. $ 4.9

100 basis points-percentage ............................................... 27.4%

200 basis points-dollars .................................................. $ 8.8

200 basis points-percentage ............................................... 49.0%

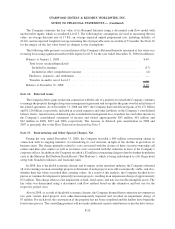

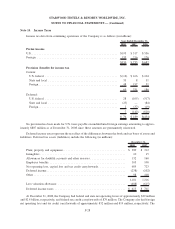

Note 11. Fair Value

In accordance with SFAS No. 157, the following table presents the Company’s fair value hierarchy for its

financial assets and liabilities measured at fair value on a recurring basis as of December 31, 2008 (in millions):

Level 1 Level 2 Level 3 Total

Assets:

Forward contracts.................................. $— $ 6 $— $ 6

Retained Interests.................................. — — 19 19

$— $ 6 $19 $25

Liabilities:

Forward contracts.................................. $— $ 3 $— $ 3

The forward contracts are over the counter contracts that do not trade on a public exchange. The fair values of

the contracts are based on inputs such as foreign currency spot rates and forward points that are readily available on

public markets, and as such, are classified as Level 2. The Company considered both its credit risk, as well as its

counterparties’ credit risk in determining fair value and no adjustment was made as it was deemed insignificant

based on the short duration of the contracts and the Company’s rate of short-term debt.

F-25

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)