Starwood 2008 Annual Report Download - page 160

Download and view the complete annual report

Please find page 160 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.determined it is not the primary beneficiary of any of the variable interest entities (“VIEs”) and they should not be

consolidated in the Company’s financial statements.

In all cases, the VIEs associated with the Company’s variable interests are hotels for which the Company has

entered into management or franchise agreements with the hotel owners. The Company is paid a fee primarily based

on financial metrics of the hotel. The hotels are financed by the owners, generally in the form of working capital,

equity, and debt.

At December 31, 2008, the Company has approximately $66 million of investments associated with 19 VIEs,

equity investments of $10 million associated with one VIE, and a loan balance of $5 million associated with one

VIE. As the Company is not obligated to fund future cash contributions under these agreements, the maximum loss

equals the carrying value. In addition, the Company has not contributed amounts to the VIEs in excess of their

contractual obligations.

At December 31, 2007, the Company had approximately $52 million of investments associated with 20 VIEs,

equity investments of $11 million associated with two VIEs and loan balances of $7 million associated with two

VIEs.

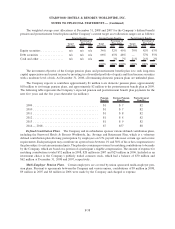

Guaranteed Loans and Commitments. In limited cases, the Company has made loans to owners of or

partners in hotel or resort ventures for which the Company has a management or franchise agreement. Loans

outstanding under this program totaled $28 million at December 31, 2008. The Company evaluates these loans for

impairment, and at December 31, 2008, believes these loans are collectible. Unfunded loan commitments

aggregating $64 million were outstanding at December 31, 2008, none of which are expected to be funded in

2009 and $46 million are expected to be funded in total. These loans typically are secured by pledges of project

ownership interests and/or mortgages on the projects. The Company also has $110 million of equity and other

potential contributions associated with managed or joint venture properties, $52 million of which is expected to be

funded in 2009.

During 2004, the Company entered into a long-term management contract to manage the Westin Boston,

Seaport Hotel in Boston, Massachusetts, which opened in June 2006. In connection with this project, the Company

agreed to provide up to $28 million in mezzanine loans and other investments (all of which has been funded) as well

as various guarantees, including a principal repayment guarantee for the term of the senior debt which was capped at

$40 million, a debt service guarantee during the term of the senior debt, which was limited to the interest expense on

the amounts drawn under such debt and principal amortization and a completion guarantee for this project. In

January 2007 this hotel was sold and the senior debt was repaid in full. In addition, the $28 million in mezzanine

loans and other investments, together with accrued interest, was repaid in full. In accordance with the management

agreement, the sale of the hotel also resulted in the payment of a fee to the Company of approximately $18 million,

which is included in management fees, franchise fees and other income in the consolidated statement of income for

the year ended December 31, 2007. The Company continues to manage this hotel subject to the pre-existing

management agreement.

Surety bonds issued on behalf of the Company at December 31, 2008 totaled $91 million, the majority of

which were required by state or local governments relating to the Company’s vacation ownership operations and by

its insurers to secure large deductible insurance programs.

To secure management contracts, the Company may provide performance guarantees to third-party owners.

Most of these performance guarantees allow the Company to terminate the contract rather than fund shortfalls if

certain performance levels are not met. In limited cases, the Company is obliged to fund shortfalls in performance

levels through the issuance of loans. At December 31, 2008, excluding the Le Méridien management agreement

mentioned below, the Company had five management contracts with performance guarantees with possible cash

outlays of up to $74 million, $53 million of which, if required, would be funded over several years and would be

largely offset by management fees received under these contracts. Many of the performance tests are multi-year

tests, are tied to the results of a competitive set of hotels, and have exclusions for force majeure and acts of war and

F-44

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)