Starwood 2008 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

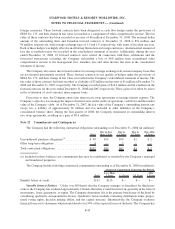

foreign currencies. These forward contracts have been designated as cash flow hedges under the provisions of

SFAS No. 133, and their change in fair value is recorded as a component of other comprehensive income. The fair

value of these contracts has been recorded as an asset of $6 million at December 31, 2008. The notional dollar

amount of the outstanding Euro and Canadian forward contracts at December 31, 2008 is $51 million and

$4 million, respectively, with average exchange rates of 1.5 and 1.0, respectively, with terms of less than one year.

Each of these hedges was highly effective in offsetting fluctuations in foreign currencies. An immaterial amount of

loss due to ineffectiveness was recorded in the consolidated statement of income. Additionally, during the year

ended December 31, 2008, 22 forward contracts were settled. In connection with these settlements and the

forecasted transactions occurring, the Company reclassified a loss of $0.8 million from accumulated other

comprehensive income to the management fees, franchise fees and other income line item in the consolidated

statement of income.

The Company also enters into forward contracts to manage foreign exchange risk on intercompany loans that

are not deemed permanently invested. These forward contracts do not qualify as hedges under the provisions of

SFAS No. 133, and their change in fair value is recorded in the Company’s consolidated statement of income. The

fair value of these contracts has been recorded as a liability of $3 million and an asset of $1 million at December 31,

2008 and December 31, 2007, respectively. The Company recorded gains of $14.4 million and $4.2 million on the

forward contracts for the years ended December 31, 2008 and 2007 respectively. These gains were offset by losses

in the revaluation of cross-currency intercompany loans.

From time to time, the Company enters into interest rate swap agreements to manage interest expense. The

Company’s objective is to manage the impact of interest rates on the results of operations, cash flows and the market

value of the Company’s debt. As of December 31, 2007, the fair value of the Company’s outstanding interest rate

swaps was a liability of approximately $6 million and was included in other liabilities in the Company’s

consolidated balance sheet. During the first quarter of 2008, the Company terminated its outstanding interest

rate swap agreements, resulting in a gain of $0.4 million.

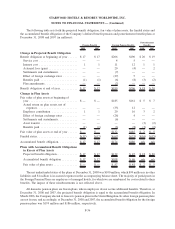

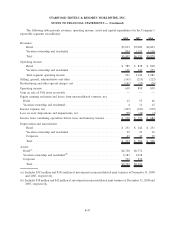

Note 23. Commitments and Contingencies

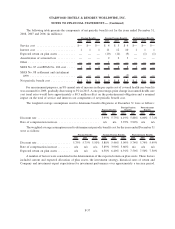

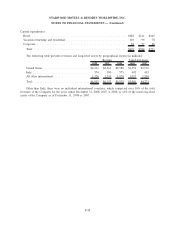

The Company had the following contractual obligations outstanding as of December 31, 2008 (in millions):

Total

Due in Less

than 1 Year

Due in

1-3 Years

Due in

3-5 Years

Due After

5 Years

Unconditional purchase obligations

(a)

............. $ 98 $35 $59 $2 $ 2

Other long-term obligations .................... 4 — 3 1 —

Total contractual obligations .................... $102 $35 $62 $3 $ 2

(a) Included in these balances are commitments that may be reimbursed or satisfied by the Company’s managed

and franchised properties.

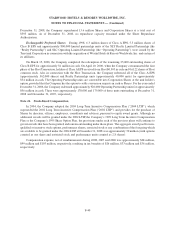

The Company had the following commercial commitments outstanding as of December 31, 2008 (in millions):

Total

Less Than

1 Year 1-3 Years 3-5 Years

After

5 Years

Amount of Commitment Expiration Per Period

Standby letters of credit .......................... $115 $115 $— $— $—

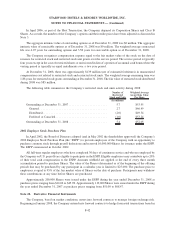

Variable Interest Entities. Of the over 800 hotels that the Company manages or franchises for third party

owners, the Company has evaluated approximately 21 hotels that it has a variable interest in, generally in the form of

investments, loans, guarantees, or equity. The Company determines if it is the primary beneficiary of the hotel by

considering qualitative and quantitative factors. Qualitative factors include evaluating distribution terms, propor-

tional voting rights, decision making ability, and the capital structure. Quantitatively, the Company evaluates

financial forecasts to determine which would absorb over 50% of the expected losses of the hotel. The Company has

F-43

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)