Starwood 2008 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

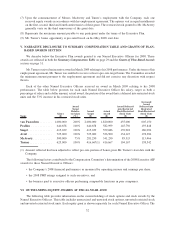

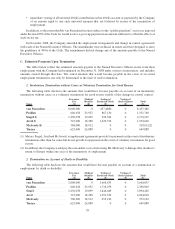

(1) The following Directors elected to receive stock awards in lieu of cash fees for service on special committees of

the Board: Ms. Barshefsky and Mr. Chapus, $20,000; Mr. Duncan, $35,000; Mr. Hippeau, $40,000; Mr.

Quazzo, $45,000; and Mr. Ryder, $30,000. The grant date fair value of these stock awards is set forth below:

Director Grant Date

Number of Shares of

Stock/Units Grant Date Fair Value ($)

Ms. Barshefsky and Mr. Chapus ....... 2/28/2008 411 19,977

Mr. Duncan....................... 2/28/2008 720 34,996

Mr. Hippeau ...................... 2/28/2008 822 39,953

Mr. Quazzo ....................... 2/28/2008 925 44,960

Mr. Ryder ........................ 2/28/2008 617 29,989

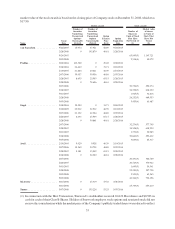

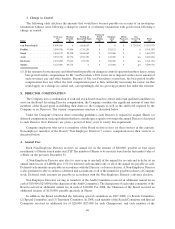

(2) As of December 31, 2008, each Director has the following aggregate number of Shares (deferred or otherwise)

outstanding: Mr. Aron, 34,292; Ambassador Barshefsky, 13,007; Mr. Chapus, 0; Mr. Clarke, 2,338; Mr. Daley,

5,657; Mr. Duncan, 238,838; Ms. Galbreath, 5,536; Mr. Hippeau, 19,360; Mr. Quazzo, 28,265; Mr. Ryder, 14,109;

Mr. Youngblood, 7,253.

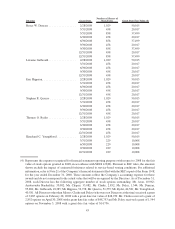

(3) Represents the expense recognized for financial statement reporting purposes with respect to 2008 for the fair

value of restricted stock and restricted stock units granted in 2008, in accordance with SFAS 123(R). Pursuant to

SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting

conditions. For additional information, refer to Note 21 of the Company’s financial statements filed with the

SEC as part of the Form 10-K for the year ended December 31, 2008. These amounts reflect the Company’s

accounting expense for these awards and do not correspond to the actual value that will be recognized by the

Directors. The grant date fair value of each stock award is set forth below:

Director Grant Date

Number of Shares of

Stock/Units Grant Date Fair Value ($)

Adam M. Aron ................... 2/28/2008 1,029 50,015

3/31/2008 458 20,017

6/30/2008 458 20,017

9/30/2008 458 20,017

12/31/2008 458 20,017

Charlene Barshefsky ............... 2/28/2008 1,029 50,015

3/31/2008 458 20,017

6/30/2008 458 20,017

9/30/2008 458 20,017

12/31/2008 458 20,017

Jean-Marc Chapus ................. 2/28/2008 1,029 50,015

3/31/2008 458 20,017

6/30/2008 153 6,687

Thomas E. Clarke ................. 4/30/2008 951 50,023

6/30/2008 229 10,008

9/30/2008 229 10,008

12/31/2008 229 10,008

Clayton C. Daley, Jr. .............. 11/5/2008 515 10,872

12/31/2008 142 6,206

42