Starwood 2008 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.extent that any tax authority succeeds in asserting that the hotel occupancy tax applies to the gross profit on these

transactions, we believe that any additional tax would be the responsibility of the intermediary. However, it is

possible that we might have additional tax exposure. In such event, such actions could have a material adverse effect

on our business, results of operations and financial condition.

Risks Relating to Ownership of Our Shares

Our Board of Directors May Issue Preferred Stock and Establish the Preferences and Rights of Such

Preferred Stock. Our charter provides that the total number of shares of stock of all classes which the Corporation

has authority to issue is 1,200,000,000, consisting of one billion shares of common stock and 200 million shares of

preferred stock. Our Board of Directors has the authority, without a vote of shareholders, to establish the preferences

and rights of any preferred or other class or series of shares to be issued and to issue such shares. The issuance of

preferred shares or other shares having special preferences or rights could delay or prevent a change in control even

if a change in control would be in the interests of our shareholders. Since our Board of Directors has the power to

establish the preferences and rights of additional classes or series of shares without a shareholder vote, our Board of

Directors may give the holders of any class or series preferences, powers and rights, including voting rights, senior

to the rights of holders of our shares.

Our Board of Directors May Implement Anti-Takeover Devices and our Charter and Bylaws Contain

Provisions which May Prevent Takeovers. Certain provisions of Maryland law permit our Board of Directors,

without stockholder approval, to implement possible takeover defenses that are not currently in place, such as a

classified board. In addition, our charter contains provisions relating to restrictions on transferability of the

Corporation Shares, which provisions may be amended only by the affirmative vote of our shareholders holding

two-thirds of the votes entitled to be cast on the matter. As permitted under the Maryland General Corporation Law,

our Bylaws provide that directors have the exclusive right to amend our Bylaws.

Our Shareholder Rights Plan Would Cause Substantial Dilution to Any Shareholder That Attempts to

Acquire Us on Terms Not Approved by Our Board of Directors. We adopted a shareholder rights plan which

provides, among other things, that when specified events occur, our shareholders will be entitled to purchase from

us a newly created series of junior preferred stock. The preferred stock purchase rights are triggered by the earlier to

occur of (i) ten days after the date of a public announcement that a person or group acting in concert has acquired, or

obtained the right to acquire, beneficial ownership of 15% or more of our outstanding Corporation Shares or (ii) ten

business days after the commencement of or announcement of an intention to make a tender offer or exchange offer,

the consummation of which would result in the acquiring person becoming the beneficial owner of 15% or more of

our outstanding Corporation Shares. The preferred stock purchase rights would cause substantial dilution to a

person or group that attempts to acquire us on terms not approved by our Board of Directors.

Item 2. Properties.

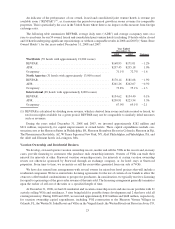

We are one of the largest hotel and leisure companies in the world, with operations in approximately 100

countries. We consider our hotels and resorts, including vacation ownership resorts (together “Resorts”), generally

to be premier establishments with respect to desirability of location, size, facilities, physical condition, quality and

variety of services offered in the markets in which they are located. Although obsolescence arising from age,

condition of facilities, and style can adversely affect our Resorts, Starwood and third-party owners of managed and

franchised Resorts expend substantial funds to renovate and maintain their facilities in order to remain competitive.

For further information see Item 7. Management’s Discussion and Analysis of Financial Condition and Results of

Operations — Liquidity and Capital Resources in this Annual Report.

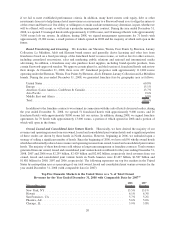

Our hotel business included 942 owned, managed or franchised hotels with approximately 285,000 rooms and

our owned vacation ownership and residential business included 26 vacation ownership resorts and residential

properties at December 31, 2008, predominantly under seven brands. All brands (other than the Four Points by

Sheraton and the Aloft and Element brands) represent full-service properties that range in amenities from luxury

hotels and resorts to more moderately priced hotels. We also lease three stand-alone Bliss Spas, two in New York,

New York and one in London, England and have leased Bliss Spas in nine of the W Hotels. In addition, we own,

lease or manage Remède Spas in four of the St. Regis hotels.

18