Starwood 2008 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

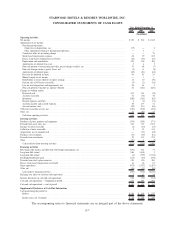

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

CONSOLIDATED STATEMENTS OF INCOME

2008 2007 2006

Year Ended December 31,

(In millions, except per share

data)

Revenues

Owned, leased and consolidated joint venture hotels ...................... $2,259 $2,429 $2,692

Vacation ownership and residential sales and services ..................... 749 1,025 1,005

Management fees, franchise fees and other income ....................... 857 834 693

Other revenues from managed and franchised properties ................... 2,042 1,865 1,589

5,907 6,153 5,979

Cost and Expenses

Owned, leased and consolidated joint venture hotels ...................... 1,722 1,805 2,023

Vacation ownership and residential ................................... 583 758 736

Selling, general, administrative and other .............................. 477 508 466

Restructuring and other special charges, net ............................ 141 53 20

Depreciation ................................................... 291 280 280

Amortization ................................................... 32 26 26

Other expenses from managed and franchised properties ................... 2,042 1,865 1,589

5,288 5,295 5,140

Operating income ............................................... 619 858 839

Equity earnings and gains and losses from unconsolidated ventures, net ....... 16 66 61

Interest expense, net of interest income of $3, $21 and $29 ................. (207) (147) (215)

Loss on asset dispositions and impairments, net ......................... (98) (44) (3)

Income from continuing operations before taxes and minority equity . ......... 330 733 682

Income tax (expense) benefit ....................................... (76) (189) 434

Minority equity in net income ...................................... — (1) (1)

Income from continuing operations .................................. 254 543 1,115

Discontinued operations:

Gain (loss) on dispositions, net of tax expense of $54, $1 and $2 . ......... 75 (1) (2)

Cumulative effect of accounting change, net of tax ....................... — — (70)

Net income .................................................... $ 329 $ 542 $1,043

Earnings (Losses) Per Share — Basic

Continuing operations ............................................ $ 1.40 $ 2.67 $ 5.25

Discontinued operations ........................................... 0.41 — (0.01)

Cumulative effect of accounting change ............................... — — (0.33)

Net income .................................................... $ 1.81 $ 2.67 $ 4.91

Earnings (Losses) Per Share — Diluted

Continuing operations ............................................ $ 1.37 $ 2.57 $ 5.01

Discontinued operations ........................................... 0.40 — (0.01)

Cumulative effect of accounting change ............................... — — (0.31)

Net income .................................................... $ 1.77 $ 2.57 $ 4.69

Weighted average number of Shares .................................. 181 203 213

Weighted average number of Shares assuming dilution .................... 185 211 223

Distribution and dividends declared per Share........................... $ 0.90 $ 0.90 $ 0.84

The accompanying notes to financial statements are an integral part of the above statements.

F-4