Starwood 2008 Annual Report Download - page 105

Download and view the complete annual report

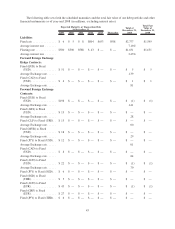

Please find page 105 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Gross capital spending during the year ended December 31, 2008 included approximately $282 million in

renovations of our wholly owned assets including construction costs at the Sheraton Suites in Philadelphia, PA,

Sheraton Steamboat Resort in Colorado, Sheraton in Fiji, The Phoenician in Scottsdale, AZ, W Times Square in

New York, NY, Aloft Philadelphia, in Philadelphia, PA, and the Aloft and Element hotels in Lexington, MA.

Investment spending on gross VOI inventory was $402 million, which was offset by cost of sales of $123 million

associated with VOI sales. The inventory spend included VOI construction at the Sheraton Vistana Villages in

Orlando, FL, the Westin St. John Resort and Villas in the Virgin Islands, the Westin Riverfront Resort in Avon, CO,

the Westin Nanea Ocean Resort Villas in Maui, HI, the Westin Desert Willow Villas in Palm Desert, CA, and the

Westin Lagunamar Ocean Resort in Cancun, as well as construction costs at the St. Regis Bal Harbour Resort in

Miami Beach, FL.

As a result of the global economic climate, we have scaled back our plans for capital expenditures in 2009. Our

capital expenditure program includes both offensive and defensive capital. Defensive spend is related to repairs,

maintenance, and renovations that we believe is necessary to stay competitive in the markets we are in. Other than

capital to address fire, life and safety issues, we consider defensive capital to be discretionary and reductions to this

capital program could result in decreases to our cash flow from operations, as hotels in certain markets could

become less desirable. The offensive capital expenditures, which are primarily related to new projects that we

expect will generate a return, are also considered discretionary. We currently anticipate that our defensive capital

expenditures for 2009 (excluding vacation ownership and residential inventory) will be approximately $150 million

for maintenance, renovations, and technology capital. The majority of this capital would be discretionary and would

be unrelated to fire, life and safety issues. In addition, we currently expect to spend approximately $175 million for

investment projects, including construction of the St. Regis Bal Harbour and various joint ventures and other

investments.

In order to secure management or franchise agreements, we have made loans to third-party owners, made

minority investments in joint ventures and provided certain guarantees and indemnifications. See Note 23 of the

consolidated financial statements for discussion regarding the amount of loans we have outstanding with owners,

unfunded loan commitments, equity and other potential contributions, surety bonds outstanding, performance

guarantees and indemnifications we are obligated under, and investments in hotels and joint ventures.

We intend to finance the acquisition of additional hotel properties (including equity investments), construction

of the St. Regis Bal Harbour, hotel renovations, VOI and residential construction, capital improvements, technology

spend and other core and ancillary business acquisitions and investments and provide for general corporate purposes

(including dividend payments and share repurchases) through our credit facilities described below, through the net

proceeds from dispositions, through the assumption of debt, and from cash generated from operations.

We periodically review our business to identify properties or other assets that we believe either are non-core

(including hotels where the return on invested capital is not adequate), no longer complement our business, are in

markets which may not benefit us as much as other markets during an economic recovery or could be sold at

significant premiums. We are focused on enhancing real estate returns and monetizing investments.

Since 2006, we have sold 56 hotels realizing proceeds of approximately $5 billion in numerous transactions

(see Note 5 of the consolidated financial statements). There can be no assurance, however, that we will be able to

complete future dispositions on commercially reasonable terms or at all.

39