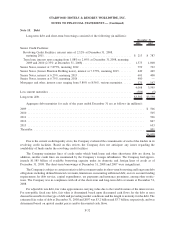

Starwood 2008 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

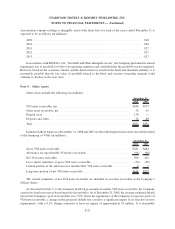

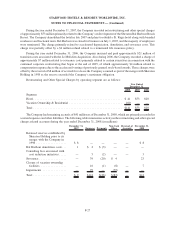

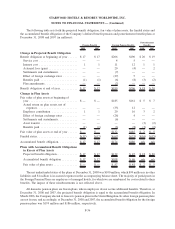

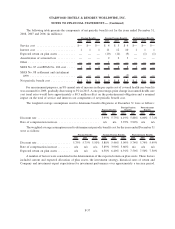

Note 15. Debt

Long-term debt and short-term borrowings consisted of the following (in millions):

2008 2007

December 31,

Senior Credit Facilities:

Revolving Credit Facilities, interest rates of 2.32% at December 31, 2008,

maturing 2011 ...................................................... $ 213 $ 787

Term loan, interest rates ranging from 1.88% to 2.69% at December 31,2008, maturing

2009 and 2010 (2.35% at December 31, 2008) .............................. 1,375 1,000

Senior Notes, interest at 7.875%, maturing 2012 ................................ 799 792

Senior Notes (former Sheraton Holding notes), interest at 7.375%, maturing 2015........ 449 449

Senior Notes, interest at 6.25%, maturing 2013 ................................. 601 400

Senior Notes, interest at 6.75%, maturing 2018 ................................. 400 —

Mortgages and other, interest rates ranging from 5.80% to 8.56%, various maturities...... 171 167

4,008 3,595

Less current maturities ................................................... (506) (5)

Long-term debt ......................................................... $3,502 $3,590

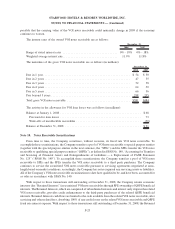

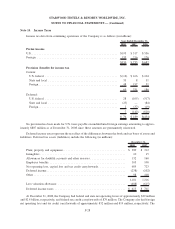

Aggregate debt maturities for each of the years ended December 31 are as follows (in millions):

2009 ........................................................................ $ 506

2010 ........................................................................ 505

2011 ........................................................................ 596

2012 ........................................................................ 847

2013 ........................................................................ 653

Thereafter .................................................................... 901

$4,008

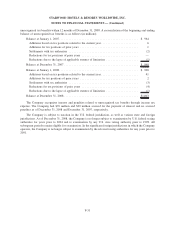

Due to the current credit liquidity crisis, the Company evaluated the commitments of each of the lenders in its

revolving credit facilities. Based on this review, the Company does not anticipate any issues regarding the

availability of funds under the revolving credit facilities.

The Company maintains lines of credit under which bank loans and other short-term debt are drawn. In

addition, smaller credit lines are maintained by the Company’s foreign subsidiaries. The Company had approx-

imately $1.585 billion of available borrowing capacity under its domestic and foreign lines of credit as of

December 31, 2008. The short-term borrowings at December 31, 2008 and 2007 were insignificant.

The Company is subject to certain restrictive debt covenants under its short-term borrowing and long-term debt

obligations including defined financial covenants, limitations on incurring additional debt, escrow account funding

requirements for debt service, capital expenditures, tax payments and insurance premiums, among other restric-

tions. The Company was in compliance with all of the short-term and long-term debt covenants at December 31,

2008.

For adjustable rate debt, fair value approximates carrying value due to the variable nature of the interest rates.

For non-public fixed rate debt, fair value is determined based upon discounted cash flows for the debt at rates

deemed reasonable for the type of debt and prevailing market conditions and the length to maturity for the debt. The

estimated fair value of debt at December 31, 2008 and 2007 was $3.2 billion and $3.7 billion, respectively, and was

determined based on quoted market prices and/or discounted cash flows.

F-32

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS — (Continued)