Starwood 2008 Annual Report Download - page 108

Download and view the complete annual report

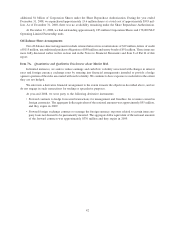

Please find page 108 of the 2008 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.additional $1 billion of Corporation Shares under the Share Repurchase Authorization. During the year ended

December 31, 2008, we repurchased approximately 13.6 million shares at a total cost of approximately $593 mil-

lion. As of December 31, 2008, there was no availability remaining under the Share Repurchase Authorization.

At December 31, 2008, we had outstanding approximately 183 million Corporation Shares and 178,000 SLC

Operating Limited Partnership units.

Off-Balance Sheet Arrangements

Our off-balance sheet arrangements include retained interests in securitizations of $19 million, letters of credit

of $115 million, unconditional purchase obligations of $98 million and surety bonds of $91 million. These items are

more fully discussed earlier in this section and in the Notes to Financial Statements and Item 8 of Part II of this

report.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

In limited instances, we seek to reduce earnings and cash flow volatility associated with changes in interest

rates and foreign currency exchange rates by entering into financial arrangements intended to provide a hedge

against a portion of the risks associated with such volatility. We continue to have exposure to such risks to the extent

they are not hedged.

We enter into a derivative financial arrangement to the extent it meets the objectives described above, and we

do not engage in such transactions for trading or speculative purposes.

At year-end 2008, we were party to the following derivative instruments:

• Forward contracts to hedge forecasted transactions for management and franchise fee revenues earned in

foreign currencies. The aggregate dollar equivalent of the notional amounts was approximately $55 million,

and they expire in 2009.

• Forward foreign exchange contracts to manage the foreign currency exposure related to certain intercom-

pany loans not deemed to be permanently invested. The aggregate dollar equivalent of the notional amounts

of the forward contracts was approximately $376 million and they expire in 2009.

42